Intel announced first-quarter earnings yesterday that are more than what Wall Street was expecting in the first place considering earnings per share, but it underperformed in sales. The company also reported growth in double digits for revenues in the client computing arm but gave a modest forecast for Q2 (the current quarter). However, Intel pledged strong gains for the second half of 2024.

Intel beat expectations but remains at loss

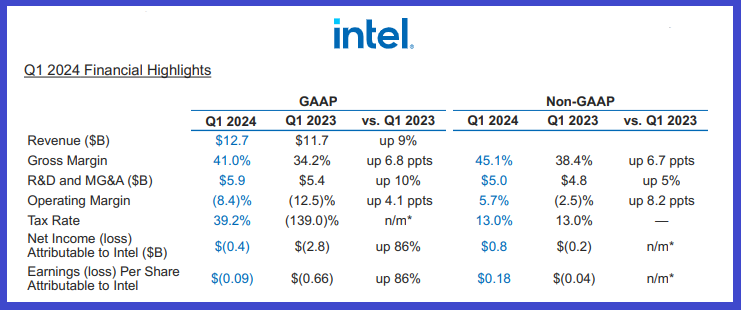

Intel reported a net loss of $400 million for the first quarter of 2024, which comes at 9 cents per share. This is a big improvement compared to the same quarter of the previous year, when the company reported a $2.8 billion net loss, or 66 cents loss per share.

Expectations for Q2 were nearly $13.6 billion in revenue, but Intel’s CFO, David Zinser, said revenue forecasts to be between $12.7 billion and $13.5 billion, which is less than what financial analysts were expecting.

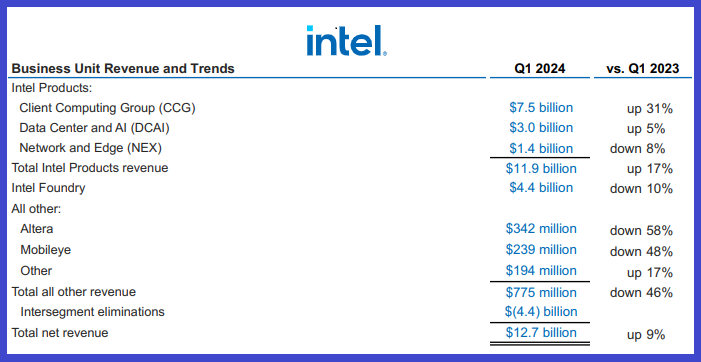

Well, its business, where Q2 forecasts were not impressive for the market, Q1 revenues were better than expected, which showed a growth of 9% year over year and were reportedly $12.7 billion. Client computing, which is the computer chips for PCs, was the main source of revenue amounting to $75 billion and has increased by 31% year over year for the first quarter.

Datacenter and AI remain bleeding spots

Considering the client computing arm performed better and is acting like a lifeline for Intel’s revenue generation, the AI initiatives and data center reported weak growth of 5% year over year with $3 billion in revenue. This side of the house includes central processor manufacturing for servers and Intel’s software development.

Intel also disclosed that it had made its silicon chip manufacturing side a separate entity called Intel Foundry, which reported $4.4 billion in revenue for the first three months of the year and is 10% down YOY, the firm announced. The foundry reported an operating loss of $2.5 billion for the first quarter.

Intel recently revealed its new AI accelerator for servers called Gaudi 3, and some Xeon 6 accelerators are also expected to be released in the same year. With the launch of these processors, Intel expects to win back some of the lost market share. As its competitor, Nvidia is working aggressively on AI-focused processors.

Pat Gelsinger, CEO of Intel, also said that investors should focus on the company’s long-term goals during the earnings call. He said Intel is one of two or maybe three companies that are capable of facilitating and advancing new chip technologies. He also hoped for better processor sales and an increase in PC sales in 2024.

Intel’s first quarter 2024 earnings call news release can be found here.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap