The tussle over global currency dominance has ramped up, with the Chinese yuan charging ahead of the US dollar. The yuan is making significant strides, especially in central and offshore financial dealings within Russia, hinting it might soon outshine the US dollar.

Yuan Gains Ground in Russia

According to a Reuters report, the yuan has surged past the US dollar to become the predominant foreign currency in Russia. New metrics show a major shift: 42% of Russia’s foreign currency transactions now involve the yuan, surpassing the dollar’s 35%.

This rise indicates a robust shift towards the yuan, spurred by Russia’s need to dodge heavy US sanctions. These sanctions have squeezed Russia out of many global financial markets, prompting a pivot to alternatives like the yuan for trade and offshore transactions.

Russia is reportedly gearing up to triple its yuan transactions beyond the previous high of $385 billion in 2023. This change comes as Russia seeks to lessen its reliance on traditional financial channels obstructed by sanctions, aiming to sustain its economy through other means.

Global Currency Interventions and Trends

The currency market is heating up globally. In Asia, nations are on their toes due to the dollar’s strength. South Korea, Thailand, and Poland are watching their currency fluctuations closely, ready to intervene if things get shaky. Indonesia is already taking action by offloading US dollars to shore up its own currency.

The situation is stirred further by recent US economic reports showing inflation rates higher than anticipated, hinting that the Federal Reserve might hold off on reducing interest rates. This has kept the dollar robust, complicating efforts in emerging markets to manage their currencies.

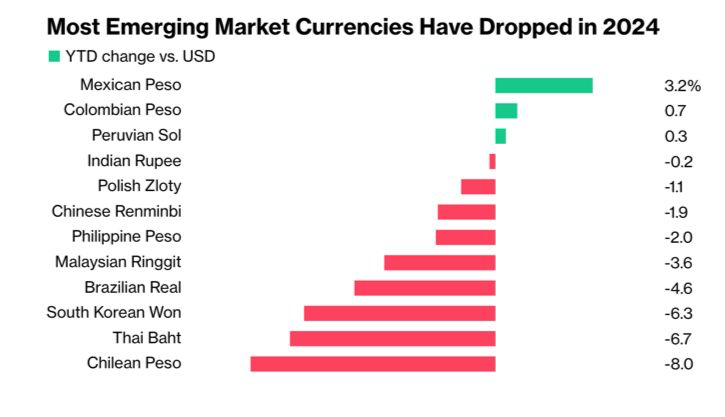

Adding to the mix are heightened tensions in the Middle East between Israel and Iran, pushing more investors towards the safety of the dollar. The landscape of emerging market currencies in 2024 is mostly down. According to Bloomberg data from April 12, 2024, currencies like the Mexican Peso, Colombian Peso, and others have dropped against the dollar, with declines ranging from 0.2% to as much as 8%.

Marcella Chow, a strategist at JPMorgan, points out the frequent interventions by central banks to stabilize their currencies. “Right now, we do see lots of verbal intervention from different central banks,” Chow said in a Bloomberg TV interview. She noted that given the Fed’s current stance, Asian currencies might face further declines, necessitating even more interventions.

This flurry of central bank activity around the world is a reaction to the US Federal Reserve’s inclination to keep interest rates higher for longer. Market traders have reduced their expectations for US rate cuts, a move driven by persistent inflation, leaving emerging markets to navigate these troubled financial times.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap