As the cryptocurrency market experiences a resurgence amid the ongoing bull run, investors are actively seeking out the best assets to bolster their portfolios. With the SEC’s recent approval of twelve Bitcoin spot ETFs, the market’s upward trajectory has been further fueled, underscoring the growing interest in digital assets. Against this backdrop, discerning investors are keen to identify the top cryptocurrencies with promising potential for long-term investment.

From the pioneering stature of Bitcoin as the original cryptocurrency to Ethereum‘s dominance in smart contract technology and from the robust infrastructure of Binance Coin to the research-driven innovations of Cardano, this guide navigates the diverse landscape of digital assets. Whether seeking high-performance solutions like Solana, eco-friendly transactions with Avalanche, or interoperability features offered by Polygon and Cosmos, investors will find insights into the most promising cryptocurrencies poised to thrive in the evolving crypto ecosystem.

Overview Of Current Crypto Market Landscape

Following a period of volatility, the cryptocurrency market is demonstrating significant resilience and potential for growth. Recent data indicates a notable recovery, with the total market capitalization reaching $2.7 trillion, a swift rebound from previous downturns. This resurgence is led by Bitcoin, which has recently surpassed the $71,000 mark, inching closer to its all-time high. Such momentum underscores the growing investor confidence and the market’s capacity to achieve new milestones. Key indicators to watch include adoption rates, network development, and innovative use cases, pivotal in distinguishing enduring crypto assets from fleeting trends. As the market evolves, a blend of utility, tokenomics, and regulatory clarity will be critical in shaping the future landscape of cryptocurrency investments.

Major Trends Influencing the Crypto Landscape

The cryptocurrency landscape in 2024 is poised for transformative growth, driven by several pivotal trends. Mainstream adoption is accelerating as Wall Street banks and large institutions increasingly engage with digital assets, signaling a broader acceptance of cryptocurrency in the financial ecosystem.

The explosion of cryptocurrency ETFs facilitates this shift, offering retail and institutional investors diverse investment avenues as regulatory concerns wane.

Technological advancements enhance scalability and interoperability across networks, enabling faster and more cost-effective transactions. This progress and a focus on compliance and regulation ensure a stable environment for cryptocurrency projects to thrive. The surge in institutional investment is a testament to crypto’s maturing appeal, with pensions, hedge funds, and endowments diversifying into digital assets.

Decentralized finance (DeFi) is at the forefront of innovation, promising to redefine traditional financial services through blockchain technology. With the DeFi sector’s total value projected to exceed $100 billion, platforms like Aave and UniSwap are set to benefit significantly. Similarly, non-fungible tokens (NFTs) are expanding their reach beyond the art world into virtual worlds and digital economies, with the market for digital collectibles poised to hit over $80 billion.

Regulation continues to shape the crypto market’s trajectory, with initiatives like the EU’s MiCA regulations and the US SEC’s actions influencing investor sentiment. Despite these challenges, the crypto market’s resilience is evident, supported by the approval of Bitcoin Spot ETFs and anticipation around the Bitcoin halving event, promising a so-called “supply shock” and potential for a new Bitcoin all-time high.

These trends and a favorable shift in interest rates suggest a bullish outlook for crypto in 2024. Integrating blockchain into gaming, metaverses, and Web 3.0 applications further underscores the sector’s broad potential. As the landscape evolves, Bitcoin and Ethereum, alongside agile altcoins focusing on DeFi and NFTs, are well-positioned to capitalize on these developments, heralding a new era of growth and innovation in the cryptocurrency market.

How We Choose the Best Cryptos

Investors constantly seek strategies to identify assets with the highest growth potential in the rapidly evolving cryptocurrency market. The complexity and volatility of the market demand a nuanced understanding of both technological innovations and market dynamics. Successful investment in this space is not merely about catching the latest trend but involves a deep dive into the fundamental attributes that signal long-term value and stability.

Market Capitalization and Liquidity

Closely related to trading volume, liquidity measures the ease with which an asset can be bought or sold in the market without affecting its price significantly. High liquidity is essential for minimizing the cost of trading and reducing the risk of price manipulation. It ensures that transactions can be executed swiftly and at stable prices, reflecting the asset’s market strength and the confidence of its participants.

Utility, adoption, and real-world applications

At the heart of a cryptocurrency’s potential is its purpose and the innovation it brings to the table. A prime example is Ethereum, which significantly diverged from Bitcoin’s primary function as a digital store of value by introducing smart contracts and decentralized applications (dApps). This utility has propelled Ethereum’s value and opened up a new realm of possibilities within the blockchain ecosystem. The lesson here is clear: cryptocurrencies that offer unique solutions or address specific challenges possess a foundational advantage that can lead to sustained growth.

Beyond Market Trends: In-depth analysis

Understanding the potential of a cryptocurrency extends beyond observing surface-level market trends. It thoroughly examines blockchain metrics to assess the network’s strength and adoption, project metrics that reveal the team’s vision and roadmap, and financial metrics concerning token distribution and supply dynamics.

Moreover, the regulatory environment is pivotal, as government policies can significantly influence a cryptocurrency’s adoption and use. An informed investor must also consider social and political factors that could affect market sentiment and, consequently, the asset’s value.

Innovation and Sector Leadership

The team behind a cryptocurrency project is a critical determinant of its success. Evaluating the team’s experience, track record, and expertise provides insights into their capability to execute the project’s vision. A history of successful ventures and relevant industry experience among team members are positive indicators of a project’s potential to thrive.

An engaged and active community is often a harbinger of a cryptocurrency project’s success. It reflects the current user base’s enthusiasm, support, and potential for wider adoption. A project that fosters open communication and actively involves the community in its development process is more likely to innovate and adapt effectively over time.

A project’s white paper is a critical document that outlines its objectives, strategy, and technical details. A well-crafted white paper presents realistic goals and a clear roadmap, serving as a blueprint for the project’s development. Conversely, white papers that lack clarity or present overly ambitious targets may signal unrealistic expectations or a lack of feasibility.

Technical Analysis and Historical Performance

By examining historical price patterns, the technical analysis offers valuable insights into market sentiment and potential price movements. However, it should be complemented with robust risk management strategies to mitigate the inherent risks of cryptocurrency investments. Understanding and preparing for market volatility can prevent impulsive decisions driven by fear or greed, ensuring a more stable and thoughtful investment approach.

The cryptocurrency market’s continuous evolution demands constant learning and adaptation from investors. Staying informed about technological advancements, market trends, and regulatory changes is crucial for making informed decisions. Moreover, exploring new areas such as decentralized finance (DeFi), non-fungible tokens (NFTs), and the emerging Web 3.0 landscape can uncover new investment opportunities.

Blockchain metrics (On-Chain Metrics)

Blockchain metrics, often called on-chain metrics, are the pulse of a cryptocurrency’s network health and activity. These metrics include the number of active addresses, transaction volume, and network hash rate. A rising number of active addresses and transaction volumes can indicate a growing adoption and usage of cryptocurrency, suggesting a robust and active network. Similarly, a strong or improving hash rate points to network security and miner confidence. Together, these on-chain metrics provide a comprehensive view of a cryptocurrency’s robustness, adoption rate, and overall potential.

Trading volume

Trading volume represents the total number of assets exchanged over a given period and is a critical metric for evaluating the interest and activity surrounding a cryptocurrency. High and consistent trading volume indicates significant investor interest and market activity, suggesting the asset’s strong presence across exchanges and ease of trading.

For instance, Bitcoin’s record trading volume during its crash in November 2022 highlighted the asset’s volatility and the high level of engagement from traders and investors, underscoring its importance in the market.

Tokenomics

Tokenomics, or the economic model of a token, encompasses the supply and demand dynamics that determine its price and distribution. Critical questions include the token’s utility, issuance mechanisms, and any token-burning provisions that can reduce supply and potentially increase value.

The allocation of tokens to the team and early investors and the schedule for their release into the market can also significantly impact price dynamics and investor confidence. Understanding tokenomics is crucial for assessing a cryptocurrency’s long-term sustainability and investment potential.

Best cryptocurrencies to buy now in 2024

Navigating the initial steps of cryptocurrency investment is just the beginning; the subsequent decisions regarding where to purchase and how to store your digital assets are equally crucial for safeguarding your investment.

Choosing the right platform for buying cryptocurrency is paramount, as it impacts not only the range of assets available but also the security measures and fees involved; diversification and strategic selection are key to building a resilient long-term crypto portfolio. In 2024, it’s essential to consider a mix of cryptocurrencies that not only have established a stronghold in the market but are also at the forefront of innovation within the blockchain space

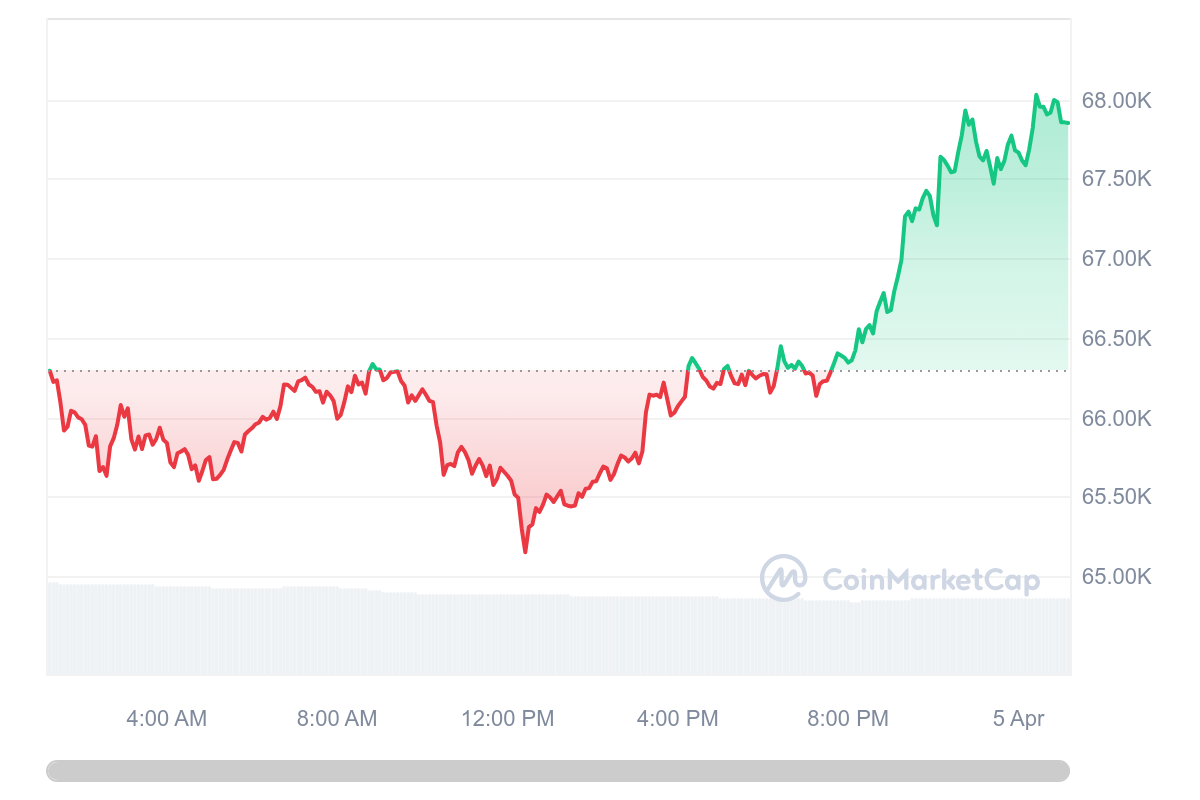

Bitcoin (BTC): The Original Cryptocurrency

The narrative around Bitcoin (BTC), at a market price of $69,245.16, the vanguard of the cryptocurrency world since its inception in 2009, speaks volumes about the evolution and maturation of digital currencies. As a pioneering force, Bitcoin has witnessed and shaped the trajectory of the cryptocurrency market, navigating through periods of extreme volatility—a characteristic trait of this nascent asset class.

Investors drawn to cryptocurrencies for their potential high returns are concurrently wary of their inherent risks, making Bitcoin’s established presence and substantial market capitalization key to its appeal.

With a valuation approximating $1.2 trillion, Bitcoin’s dominance underscores its stature within the cryptocurrency ecosystem, accounting for roughly 53% of the market’s total value.

This prominence reflects its first-mover advantage and the depth of its integration and acceptance across financial landscapes.

A significant milestone in Bitcoin’s journey toward mainstream financial acceptance was the introduction of Bitcoin exchange-traded funds (ETFs) in January. These ETFs represent a watershed in Bitcoin’s history, facilitating exposure to its price movements for investors within traditional financial markets, bypassing the complexities of direct cryptocurrency ownership.

The approval of spot Bitcoin ETFs marked the culmination of prolonged advocacy efforts, signaling regulatory acknowledgment of Bitcoin’s legitimacy and potential as an investable asset.

The price trajectory of Bitcoin, especially its rally from below $17,000 at the outset of 2023 to over $62,000 in early 2024, illustrates the dynamic nature of its market value. This substantial appreciation, particularly notable with a 47.9% increase in value through February 28, 2024, has been significantly influenced by the approval and subsequent popularity of spot Bitcoin ETFs.

These instruments have democratized access to Bitcoin investment and attracted substantial capital, evidenced by the rapid accumulation of assets under management.

This evolution of Bitcoin—from an experimental digital currency to a cornerstone of the cryptocurrency market with broad institutional and retail investor acceptance—reflects its resilience and the growing confidence in its role as “digital gold.”

The adoption of Bitcoin ETFs is a pivotal development, heralding a new era for cryptocurrency by bridging the gap between the traditional financial system and the burgeoning world of digital assets.

As Bitcoin continues to navigate its path forward, its ability to adapt and integrate within the broader financial ecosystem will remain critical in its sustained relevance and value.

Ethereum (ETH): The Leading Smart Contract Platform

Ethereum (ETH) $3,517.14 stands as a cornerstone in the realm of blockchain, ushering in the era of smart contracts and decentralized applications (dApps). This blockchain network transcends mere cryptocurrency transactions, providing a versatile platform for developers globally.

Ethereum’s innovation lies in its smart contract functionality, enabling automated, self-executing contracts that execute when predefined conditions are met. This feature has propelled Ethereum to the forefront of decentralized finance (DeFi), non-fungible tokens (NFTs), and various other blockchain-based applications.

Introduced by Vitalik Buterin in 2013, with the network going live in 2015, Ethereum’s journey from concept to a leading blockchain network underscores its pivotal role in the digital asset space.

The transition to a Proof-of-Stake consensus mechanism in September 2022, known as the Merge, marked a significant step towards energy efficiency and scalability. Looking ahead, Ethereum is set to implement sharding to enhance network capacity and reduce transaction fees, further solidifying its position as a scalable and accessible platform.

Ethereum’s utility extends beyond powering its native cryptocurrency, Ether (ETH), as the backbone for a thriving ecosystem of dApps. These applications span various sectors, including finance, gaming, and digital art, contributing to Ethereum’s substantial market capitalization of approximately $417 billion.

The network’s capability to process transactions and support digital economies at scale is evidenced by its daily transaction volume, rivaling traditional payment systems like PayPal.

The introduction of Ethereum ETFs is on the horizon, reflecting the growing institutional interest and the potential for broader adoption of ETH as a fundamental asset in digital finance. Ethereum’s role in the future of the internet, Web3, and the digital economy is indisputable, with its technology enabling innovative applications that challenge the status quo of centralized services.

As Ethereum continues to evolve, its contribution to the blockchain domain and its impact on various industries remain unparalleled. With developments like the Dencun network upgrade set to enhance functionality, Ethereum is poised for continued growth and adoption, making it a pivotal player in the cryptocurrency and blockchain landscape.

Binance Coin (BNB): The Exchange’s Backbone

Binance Coin (BNB) is the cornerstone of the Binance ecosystem, the world’s leading cryptocurrency exchange by trading volume. Introduced in July 2017, BNB has evolved beyond a mere utility token, underpinning many functionalities within the Binance universe, including the Binance Chain, Binance Smart Chain, and other projects.

This token facilitates reduced trading fees on the exchange and plays a pivotal role in the Binance Launchpool, which is used to participate in new token launches.

Currently trading at $571.8, with a market sentiment of 81.7%, BNB exhibits robust trading activity and liquidity, supported by a broad user base and the continuous addition of new use cases.

Despite its central role in Binance’s offerings, potential investors should consider the centralization concerns surrounding the Binance Smart Chain and the exchange itself, which introduces risks related to regulatory scrutiny and security.

BNB’s utility extends to Binance Pay, enabling merchants to accept BNB as payment. It is also available through Trust Wallet, which offers additional incentives for holders. The tokenomics of BNB, characterized by a burning mechanism aimed at reducing supply, suggests a thoughtful approach to value appreciation.

However, the significant allocation to founders and early investors remains a concern for potential market manipulation.

Binance Coin represents a crucial asset within the cryptocurrency space, backed by the expansive Binance ecosystem. Its success and performance are a testament to its utility and adoption, positioning it as a top contender for investment in 2024.

However, the decision to invest in BNB must be balanced with consideration of its centralized governance and the associated risks.

Cardano (ADA): A Research-Driven Blockchain Project

Cardano (ADA), launched by Ethereum co-founder Charles Hoskinson in 2017, stands out in the cryptocurrency landscape and is renowned for its proof-of-stake protocol that underscores energy efficiency and sustainability.

Positioned as a platform for changemakers and innovators, Cardano’s foundation is set on security, transparency, and fairness principles, aiming to redistribute power from centralized systems to individuals.

With a market cap surpassing $22 billion and a current trading value of approximately $0.6361, ADA reflects a robust investment vehicle, evidencing significant recovery and growth. Following a sharp decline in 2022, ADA has showcased a remarkable turnaround, nearly tripling in value from the start of 2023, signifying a promising trajectory for potential investors.

Cardano distinguishes itself with a capped supply limit of 45 billion ADA tokens, of which over 81% are already in circulation. This limit ensures a predictable dilution rate, offering a measure of scarcity and potential value appreciation over time.

The platform’s recent advancements, including the Alonzo hard fork, which introduced smart contract functionality, have further solidified its position as a leading blockchain for developing decentralized applications and smart contracts, making ADA one of the top cryptocurrencies to consider for investment in 2024.

Solana (SOL): High Performance and Fast Transactions

Solana (SOL), a Layer 1 blockchain known for its unparalleled speed and cost-efficiency, stands out as a formidable platform for decentralized applications (dApps) and smart contract execution.

Launched in March 2020 by the Solana Foundation, this blockchain has quickly ascended to prominence within the digital finance ecosystem. With a current market capitalization of over $81 billion and a trading price of $182.45, Solana demonstrates significant growth and investor interest.

Solana’s edge comes from its innovative consensus mechanisms: Proof-of-History (PoH) and Proof-of-Stake (PoS). The PoH consensus uniquely enables the network to timestamp transactions, thereby streamlining the validation process without compromising security or decentralization.

This mechanism and PoS propels Solana to achieve transaction speeds exceeding 50,000 transactions per second (TPS), addressing the blockchain trilemma effectively.

The SOL token, integral to the network, serves multiple purposes, from transaction fee payments to gas fees to network security through staking. Holders can stake their SOL directly or delegate to validators, participating actively in the network’s security and governance.

Solana’s robust infrastructure supports many DeFi, NFTs, and Web3 projects, boasting over 5,000 projects. Its capacity for high transaction volumes, evident in daily transactions worth over $5 billion and a growing user base with more than 13 million addresses, underlines its expanding footprint in the blockchain space.

Despite the competition, Solana’s position as a leading smart contract platform is reinforced by its high performance, scalability, and low transaction costs. Backed by leading venture capital firms and with a market sentiment of 64.4%, Solana presents a compelling option for investors exploring the dynamic landscape of cryptocurrencies in 2024.

Avalanche (AVAX): Low Cost and Eco-friendly Transactions

Avalanche (AVAX), a pioneering layer 1 blockchain, has emerged as a powerhouse in digital finance with its launch in 2020. Renowned for its high transaction throughput of over 4,500 transactions per second (TPS) and sub-second finality, Avalanche offers an unparalleled blend of speed, scalability, and low-cost transactions. Its market price currently stands at $53.92, reflecting a solid performance and investor confidence.

At its core, Avalanche excels in facilitating Ethereum Virtual Machine (EVM) compatible decentralized applications (dApps) and smart contracts. This compatibility has been a key driver in attracting over 350 projects from Ethereum, seeking scalability solutions without compromising on security or decentralization. With a market cap of over $20 billion, Avalanche’s financial metrics underscore its significance and potential in blockchain.

The Avalanche blockchain distinguishes itself with unique consensus protocols that enhance its efficiency and performance. Its innovative approach has led to significant milestones, such as processing 2.9 million transactions daily and initiating the Avalanche Rush initiative, injecting over $180 million to support new dApps.

Security on Avalanche is maintained through a proof-of-stake consensus mechanism, with validators playing a critical role in securing the network. The native AVAX token powers the ecosystem, covering transaction fees and staking purposes, fostering a vibrant community of users and developers.

Avalanche’s strategic vision extends to interconnecting crypto ecosystems, with the Avalanche Foundation working on developing a bridging hub. This vision positions Avalanche as a leading platform for the future Web3 and metaverse economy, offering an eco-friendly and cost-effective alternative for developers and users alike.

Given its robust technological foundation, impressive adoption rate, and commitment to innovation, Avalanche represents a compelling choice for investors looking into cryptocurrencies with strong fundamentals and growth potential in 2024.

Polygon (MATIC): Ethereum’s Internet of Blockchains

Polygon (MATIC), established as a premier platform for Ethereum scaling and infrastructure development, revolutionizes the blockchain landscape by enhancing Ethereum’s capabilities.

With a market cap of nearly $10 billion, it is a significant player in the crypto space.

Polygon’s core, the Polygon SDK, facilitates the creation of a diverse range of applications, from optimistic and ZK rollup chains to standalone chains, embodying the concept of Ethereum as a multi-chain system. This system mirrors the functionality of networks like Polkadot and Cosmos yet leverages Ethereum’s security and rich ecosystem.

MATIC tokens are crucial in system security and governance, emphasizing Polygon’s commitment to a decentralized financial landscape. Boasting up to 65,000 transactions per second and swift block confirmation, Polygon ensures scalability and efficiency. It supports a thriving environment for DApps, making it an indispensable tool for developers and a prime choice for investors seeking robust, scalable blockchain solutions in 2024.

Cosmos (ATOM): The Blockchain Interoperability Leader

Cosmos (ATOM), acclaimed as the “Internet of Blockchains,” facilitates interoperability across diverse blockchain platforms. Through its innovative Cosmos Hub and the Inter-Blockchain Communication (IBC) protocol, Cosmos enables seamless connectivity between its network and external blockchains like Bitcoin and Ethereum.

This ecosystem thrives on a Proof-of-Stake consensus mechanism, ensuring robust security, swift transaction times of about 7 seconds, and minimal transaction costs, approximately $0.01. The native token, ATOM, plays a pivotal role in network security and governance, allowing users to stake their tokens for rewards and a share of the network’s transaction fees.

With a strategic cap on ATOM’s inflation rate to optimize the ecosystem’s economic model, Cosmos is steering towards enhancing decentralized finance protocols within its domain. This decision underscores Cosmos’s commitment to fostering a scalable, efficient, and interconnected blockchain environment, positioning ATOM as a prime candidate for investors looking toward the future of blockchain interoperability and scalability in 2024.

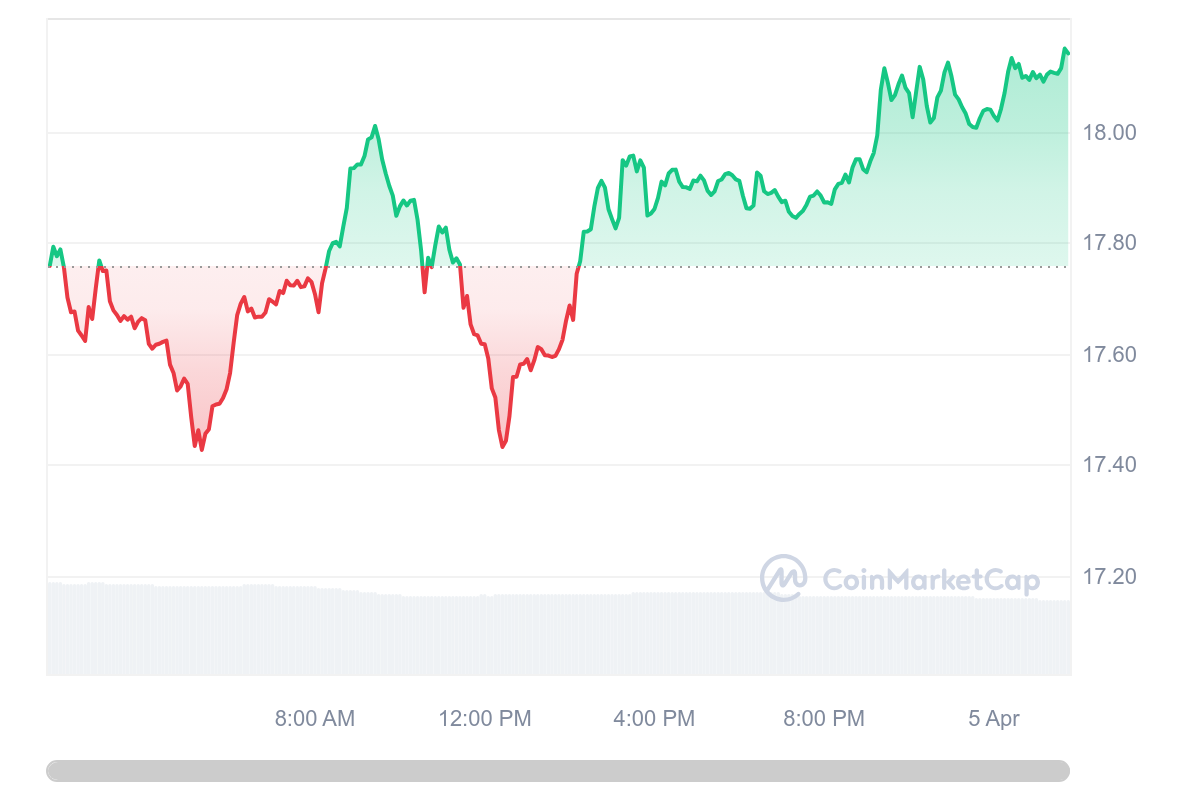

Chainlink (LINK): The Standard for Oracles

Chainlink (LINK), launched in 2017, is a pivotal blockchain abstraction layer that empowers smart contracts to securely interact with external data sources, payments, and events. This integration is facilitated through Chainlink’s decentralized oracle network, bridging the gap between on-chain and off-chain ecosystems.

Currently, LINK is trading at $19.09, reflecting its critical role in the digital agreement landscape by enabling complex smart contracts to access vital off-chain information.

The Chainlink ecosystem thrives on diverse community participation, including data providers, node operators, and developers, emphasizing decentralized involvement. Recent strategic partnerships, like those with Avalanche and the Australia and New Zealand Banking Group, have bolstered Chainlink’s market position, evidenced by a notable 9% price surge following these announcements.

This upward trend underscores Chainlink’s growing influence and the community’s confidence in its Oracle solutions, making LINK a compelling option for those considering investments in the crypto space for 2024.

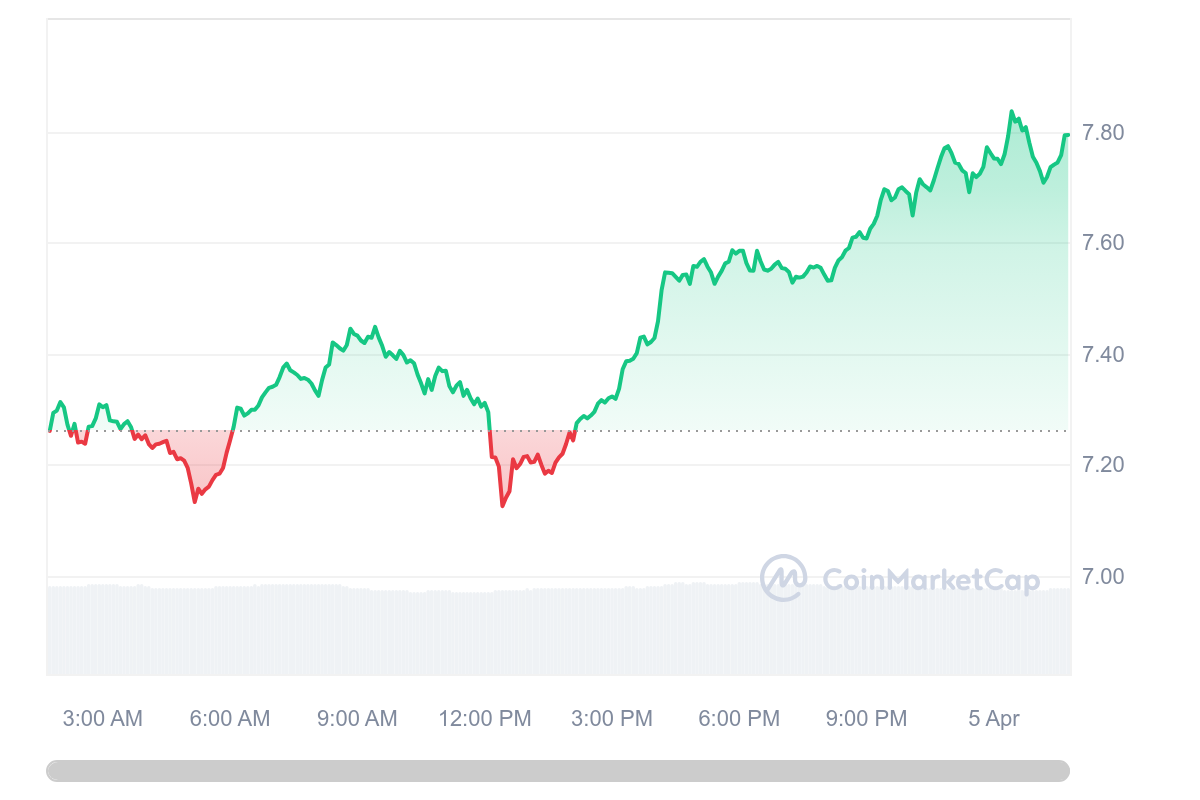

Thorchain (RUNE): Enabling Cross-Chain Liquidity

THORChain (RUNE), a pioneering decentralized liquidity protocol, facilitates seamless cryptocurrency exchanges across diverse networks like Bitcoin and Ethereum without compromising asset custody.

Trading at $8.93, THORChain’s innovative approach leverages an automated market maker model to ensure liquidity and fair market prices. RUNE, the native utility token, centralizes its utility in governance and security and is the base currency within the ecosystem, with nodes committing a minimum of 300,000 RUNE for consensus participation.

Launched through an Initial DEX Offering (IDO) on Binance DEX in July 2019, THORChain has progressed to a multi-chain upgrade in April 2021, with its Mainnet going live in June 2022. With a current market capitalization of $2.999 billion and a circulating supply of 335,853,788 RUNE, the platform’s significant trading volume and total value lock highlight its robust activity and trust within the crypto community. Given its innovative cross-chain functionality and growth trajectory, THORChain presents a compelling case for investment consideration in 2024.

Emerging Cryptocurrencies with Potential

In the vibrant landscape of emerging cryptocurrencies, certain projects stand out for their innovative approach and potential for substantial returns. Among these, Dogecoin20 (DOGE20) captivates with an astounding 385,876% APY for staking, highlighting its ambition within the meme coin sphere and its staking rewards mechanism designed for long-term stability.

With a current presale price of $0.00022 and anticipation building towards its Uniswap launch on International Doge Day, DOGE20 positions itself as a lucrative opportunity for investors seeking high-yield assets.

Ripple (XRP) stands out in the digital currency space for its significant market capitalization of £26 billion and its foundational role in the Ripple payment ecosystem. Created by the innovators behind Ripple, a leading technology and payment processing company, XRP is a pivotal medium within the network, facilitating seamless exchanges across various currency types. This functionality underscores XRP’s utility in bridging traditional and digital finance.

The price trajectory of XRP since its inception reflects its volatile nature, which is characteristic of the broader cryptocurrency market. Starting at a modest £0.004 in early 2017, XRP saw an impressive peak at approximately £1.19 by the end of April 2021. However, by 2 April 2024, its value adjusted to £0.47, illustrating the high volatility and dynamic changes in investor sentiment and market conditions that cryptocurrencies, including XRP, often experience. This volatility is critical for investors, reflecting the potential risks and opportunities within the cryptocurrency investment landscape.

Dogwifhat (WIF) emerges as a captivating meme coin within the cryptocurrency landscape, leveraging the Solana blockchain’s capabilities for fast and efficient transactions. As of the latest update, WIF is priced at $3.90, experiencing a decline of 8.61% over the past 24 hours. Despite recent fluctuations, dogwifhat achieved its All-Time High (ATH) of $4.81 on March 31, 2024, and is currently 19% below this peak.

The circulating supply of dogwifhat stands at 998.93 million tokens, with the maximum supply capped at the same amount, indicating that all tokens have been issued. WIF’s 24-hour trading volume is $672.74 million, indicating high activity and investor interest. It enjoys wide availability, being traded on 61 markets across 36 exchanges, with Binance being one of the most active platforms for WIF trading.

With a market capitalization of $3.90 billion, dogwifhat holds a 0.15% share of the entire cryptocurrency market, ranking it at 32nd. Its position on 1309 watchlists highlights its popularity and the keen interest it has garnered among cryptocurrency enthusiasts, particularly those attracted to the vibrant meme coin segment. As a meme coin, dogwifhat represents a unique blend of humor and investment potential encapsulated within the innovative and rapidly evolving

US Dollar Coin (USDC)

US Dollar Coin (USDC) is a leading figure in the stablecoin arena, boasting a market capitalization of £26 billion. USDC’s primary role as a stablecoin is to bridge the traditional financial system with the burgeoning world of cryptocurrency by maintaining a stable value directly pegged to the US dollar. This peg aims to ensure a one-to-one value ratio, making USDC a dependable choice for investors and users seeking stability in the often volatile crypto market. USDC runs on the Ethereum blockchain, leveraging its extensive network to facilitate global transactions seamlessly. This capability enhances USDC’s utility in the digital finance space and positions it as a crucial tool for various financial operations and services across the globe. Investors are encouraged to conduct their research, considering these emerging cryptocurrencies’ unique features and the broader market’s bullish momentum as the crypto landscape progresses toward 2024.

Investment Strategies for 2024

Entering the cryptocurrency market necessitates a strategy that balances the pursuit of opportunity with risk management. For those considering investments in 2024, it’s imperative to research extensively, focusing on projects with solid fundamentals and transparent roadmaps.

Diversification remains a key tactic, spreading investments across various cryptocurrencies to mitigate the impact of volatility. Implementing dollar-cost averaging (DCA) can further smooth out price fluctuations, enabling investors to build positions over time potentially lowering the average cost per coin.

Tips for New Crypto Investors

New investors should prioritize security, employing reputable wallets and keeping private keys confidential to safeguard their assets. Engaging with the crypto community through forums and social media can offer insights and support, but it’s crucial to remain critical, avoiding decisions driven by hype.

Setting realistic goals based on risk tolerance and financial situation can help maintain focus and discipline, steering clear of impulsive trades influenced by fear of missing out (FOMO).

Strategies for Long-Term Crypto Investments

For long-term investment success, selecting cryptocurrencies with a clear use case, robust technology, and a strong development team is essential. Monitoring the market for shifts in trends and sentiment while staying informed on regulatory changes can offer strategic advantages.

Secure, long-term storage solutions, like hardware wallets, are advisable for significant holdings. Moreover, a long-term perspective requires patience, recognizing that meaningful growth in the crypto market often unfolds over years, not days or weeks.

By adopting these strategies, investors can navigate the complex landscape of cryptocurrency with greater confidence and clarity, positioning themselves for potential success in the evolving digital economy.

Market Trends to Watch

Navigating the cryptocurrency market in 2024 will require a nuanced understanding of these emerging trends and a strategic approach to investment that prioritizes innovation, security, and long-term value creation.

Decentralized Finance (DeFi) Developments

The evolution of Decentralized Finance (DeFi) has been a cornerstone in the transformative journey of blockchain technology, offering a new paradigm in financial services. DeFi’s architecture, built on Ethereum and other blockchain platforms, democratizes access to financial services such as lending, borrowing, and trading through automated smart contracts, eliminating the need for traditional financial intermediaries.

As we move into 2024, investors should watch for advancements in DeFi protocols that enhance scalability, interoperability, and user experience. Integrating Layer 2 solutions and cross-chain functionalities promises to address current limitations, potentially increasing DeFi’s market cap and adoption rate.

Investors interested in DeFi projects should prioritize those with robust security measures, innovative solutions to current challenges, and a clear regulatory stance to mitigate risks while capitalizing on growth opportunities.

The Rise of Tokenization in Real-World Assets

In the 2024 crypto market trends, tokenizing real-world assets (RWA) is increasingly pivotal, bridging traditional assets like real estate, fine art, and precious metals with blockchain technology. This innovation offers many benefits, including secure, decentralized trading and the transparency of property rights.

Importantly, it democratizes investment in traditionally illiquid assets by fractionalizing ownership into digital tokens, lowering entry barriers for smaller investors. Moreover, blockchain’s transparency enhances the verifiability of real estate and art transactions. Intangible assets like copyrights and patents also gain from immutable blockchain storage, ensuring tamper-proof records.

Additionally, the tokenization trend extends to credit markets, with significant growth in tokenized private credit and US treasuries, alongside emerging markets like tokenized carbon credits, facilitating easier access to climate action funding and carbon offset purchases.

Play to Earn (P2E) Gaming Expansion

Play-to-earn (P2E) gaming has emerged as a revolutionary model that rewards players with tangible assets for their participation and achievements within virtual worlds. As we approach 2024, the P2E sector is expected to grow significantly, driven by integrating blockchain technology, NFTs, and decentralized finance elements into gaming ecosystems. This expansion will likely attract new users seeking entertainment and economic gains. For investors, P2E projects that balance engaging gameplay, sustainable economic models, and community-driven development are poised for success.

Attention should also be given to platforms that offer cross-game interoperability and partnerships with traditional gaming industries to broaden their appeal and usability.

Integration of Blockchain & Artificial Intelligence

In 2024, the intertwining of blockchain and Artificial Intelligence (AI) heralds a new era of innovation across diverse sectors. This integration capitalizes on blockchain’s strengths in ensuring security, transparency, and decentralization alongside AI’s data analytics, automation, and predictive modeling capabilities.

Key trends include bolstered data privacy, secure AI transactions, and the rise of decentralized AI marketplaces, enhancing accessibility to algorithm trading and data sharing. Investment opportunities are rife in projects that bridge AI and blockchain, particularly those offering infrastructure support for AI applications and those developing autonomous AI solutions.

Noteworthy examples include Akash, Render, and Fetch.ai, which aim to democratize AI applications and foster a decentralized AI ecosystem. As these technologies converge, they unlock new possibilities for innovation, security, and efficiency, making them critical for investors to watch.

Managing Your Crypto Investments

Managing your crypto investments requires a strategic approach that balances the pursuit of growth with risk management. It involves regularly monitoring the market, staying informed about the latest developments, and adjusting your portfolio as needed.

Diversification across different cryptocurrencies and asset classes can mitigate risk and enhance potential returns. Utilizing secure wallets and exchanges, tracking your transactions for tax purposes, and employing tools for portfolio management are essential practices.

Moreover, setting clear investment goals and adhering to a disciplined investment strategy, such as dollar-cost averaging, can help navigate the volatility inherent in the crypto market.

By combining thorough research, sound security practices, and a well-considered investment strategy, you can effectively manage your crypto investments and position yourself for long-term success in digital assets.

Crypto Tax and Tracking Considerations

Navigating the complex landscape of cryptocurrency taxes is crucial for investors aiming to stay compliant with regulatory requirements. The IRS categorizes cryptocurrencies as property, subjecting them to capital gains taxes.

Investors should meticulously track their transactions, including trades, purchases, and sales, to accurately report gains or losses. Utilizing dedicated crypto tax software can streamline this process, automatically generating required tax forms based on historical data.

Moreover, understanding the tax implications of specific transactions, such as staking rewards or airdrops, is essential. As tax regulations around cryptocurrencies evolve, staying informed through credible sources and seeking advice from tax professionals specializing in crypto transactions is advisable. Proactively managing crypto taxes ensures legal compliance and aids in strategic investment planning and optimizing tax liabilities.

Importance of Portfolio Diversification

Diversification is a strategic approach to managing investment risk by spreading assets across various cryptocurrencies and other financial instruments. A well-diversified crypto portfolio can mitigate the impact of market volatility, reducing the risk of significant losses from a single investment.

A mix of established cryptocurrencies like Bitcoin and Ethereum with emerging projects and tokens across different sectors, such as DeFi, NFTs, and P2E gaming, can offer a balanced risk-reward ratio. Beyond crypto assets, integrating traditional investments such as stocks, bonds, and real estate can further enhance portfolio stability.

Diversification strategies should align with individual risk tolerance, investment goals, and market outlook. Regularly reviewing and adjusting the portfolio composition in response to market changes or personal financial goals is essential for maintaining an effective diversification strategy.

Conclusion

As we approach 2024, the landscape of cryptocurrency investment is teeming with opportunities, underscored by a need for strategic navigation. A holistic strategy that embraces meticulous research, robust diversification, and stringent security measures is essential to forging a path through this dynamic domain.

Recognizing projects backed by reputable investors or venture capital firms is critical in identifying promising investment opportunities. Such backing serves as a testament to a project’s credibility and potential for success and highlights the confidence of seasoned market participants in its technological and market viability.

Additionally, staying informed about evolving trends, including blockchain’s integration with artificial intelligence and the burgeoning field of tokenization, opens up new avenues for growth. Thus, in the ever-evolving digital currency arena, success hinges on an investor’s ability to blend innovation with caution, drawing on a spectrum of resources to tap into the rich potential of cryptocurrencies while skillfully managing associated risks.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.