The 2020s are shaping up to be a challenging decade for the global economy, despite some resilient growth patterns. After the whirlwind of a pandemic, geopolitical tensions, and inflation spikes, the world stands at a critical juncture. The global economy has indeed shown remarkable resilience.

According to the IMF’s Chief Economist Pierre-Olivier Gourinchas, growth has been steady amidst a whirlwind of supply chain disruptions, an energy and food crisis sparked by geopolitical conflicts, and significant inflation spikes. The global economy has been anything but predictable, starting from the tumultuous times following the pandemic to the present.

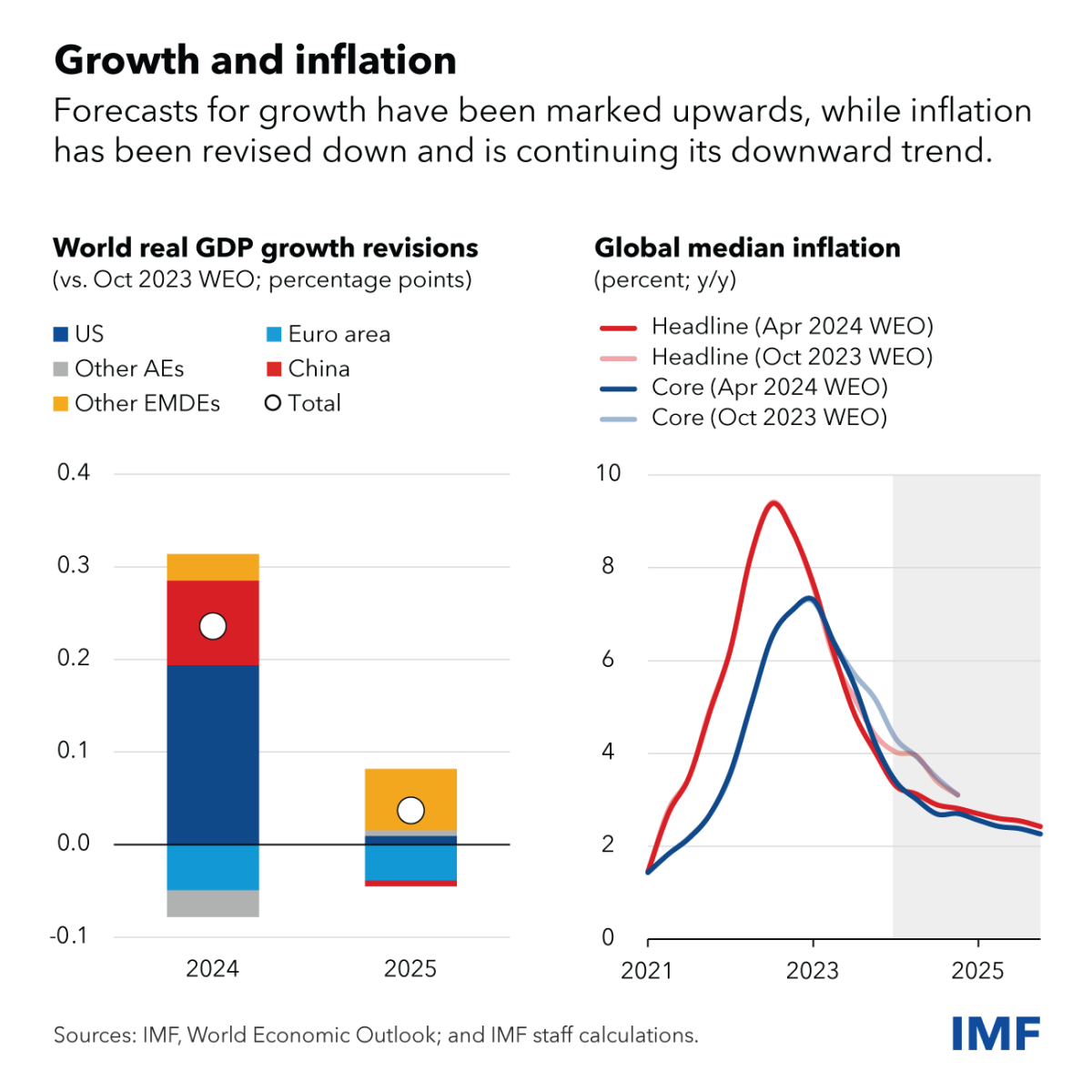

As of the end of 2022, global growth had dipped to a low of 2.3 percent just as median headline inflation reached a high of 9.4 percent. Moving forward, the IMF projects that growth will stabilize at 3.2 percent for the next couple of years, with a corresponding gradual decline in inflation rates from 2.8 percent at the end of 2024 to 2.4 percent by the end of 2025. Despite various global shocks, the indicators hint at a “soft landing.”

Inflation Risks Remain

While the global economy has navigated through past crises with resilience, inflation remains a persistent threat. The beginning of the year saw a stalling of progress toward inflation targets, potentially setting the stage for future economic complications.

A significant portion of the subdued inflation can be attributed to declining energy prices and reduced goods inflation aided by the resolution of supply chain disruptions and lower export prices from China. However, recent upticks in oil prices driven by geopolitical tensions and persistent high services inflation warrant a vigilant stance from policymakers to maintain the trajectory toward established inflation targets.

Moreover, trade restrictions on Chinese exports could potentially escalate goods inflation further, underscoring the fragile state of global economic stabilization efforts.

Economic Divergences Widen

The resilience observed in the global economy masks significant disparities among different regions. The United States, for instance, demonstrates robust economic health with strong productivity and employment growth. However, this strength also signals potential overheating, necessitating a measured approach to monetary policy easing to ensure sustainable growth without igniting inflationary pressures again.

Conversely, the euro area faces a slower recovery, with ongoing challenges such as high wage growth and persistent services inflation that could impede the normalization of inflation rates. The ECB’s careful calibration of monetary policy is crucial to avoid further economic stagnation.

China’s economic woes continue, primarily due to a downturn in its property sector and subdued domestic demand, which poses risks of escalating global trade tensions. Meanwhile, other large emerging market economies are seeing robust growth, benefiting from shifts in global supply chains and the ongoing trade frictions between China and the U.S.

Policy Path

The IMF advises that to maintain or enhance global economic resilience, strategic policy measures are essential. Top priorities include rebuilding fiscal buffers and reversing the decline in medium-term growth prospects. Effective fiscal consolidations are necessary to manage high real interest rates and less favorable sovereign debt dynamics, particularly in an environment where global elections might further complicate economic strategies.

Moreover, structural reforms in low-income countries to promote investment and resource mobilization are critical to reducing their borrowing costs and funding needs. Additionally, embracing artificial intelligence could significantly boost productivity, though this comes with its challenges, including potential disruptions in labor and financial markets.

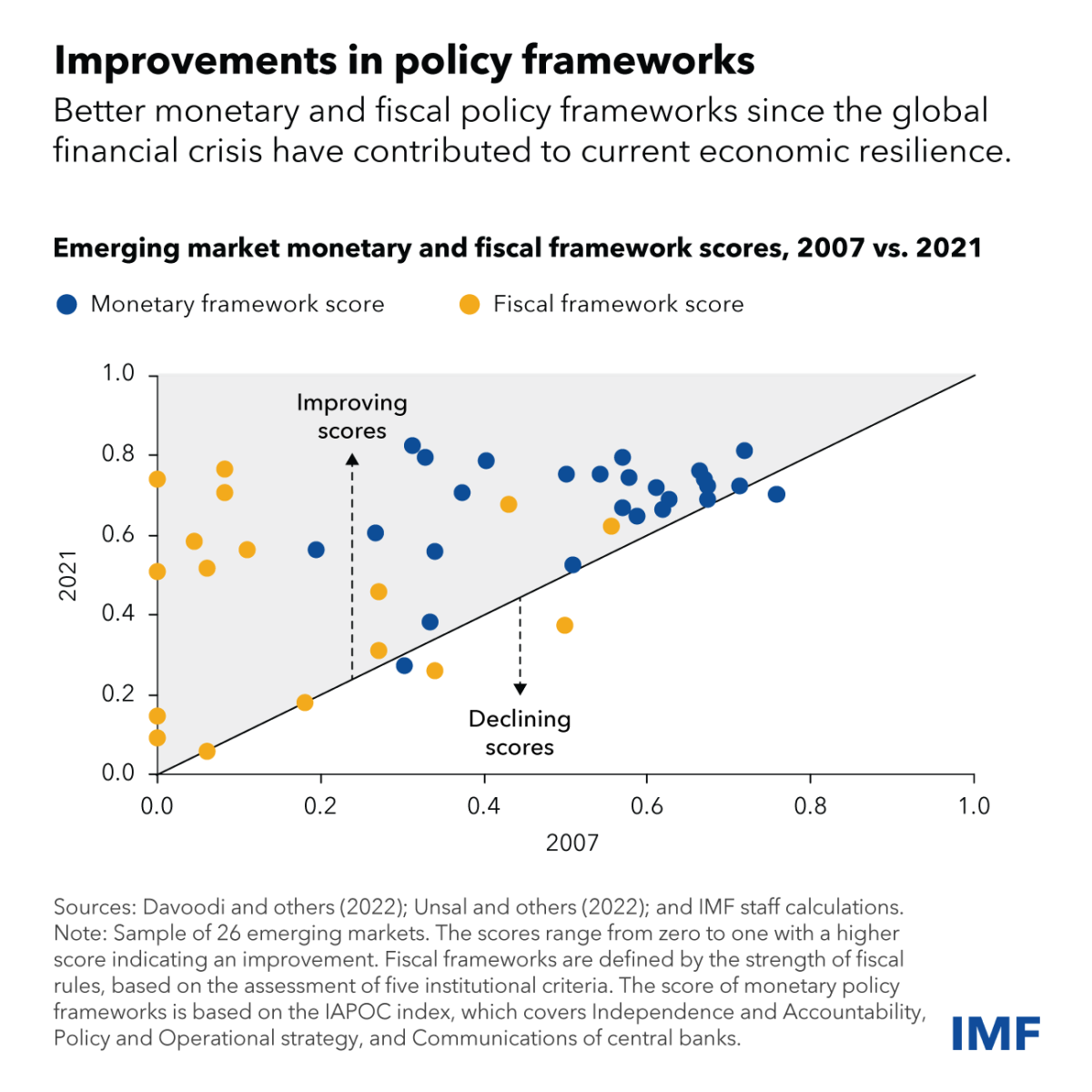

Addressing geoeconomic fragmentation and restrictive trade policies is also vital for maintaining efficiency in global trade linkages. Protecting the advancements made in monetary, fiscal, and financial policy frameworks, especially in emerging markets, will help sustain global financial system resilience and prevent a resurgence of inflation.

Lastly, accelerating the green transition through substantial investments in green technology and reducing fossil fuel dependence is essential for sustainable growth. This requires concerted efforts from advanced and developing economies alike to ensure a comprehensive approach to global environmental challenges.

You can read Pierre-Olivier Gourinchas’ full report here if you want.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan