Venture investor Marc Weinstein has aired his frustrations on Twitter, targeting Coinbase over its KYC policy which has caused him a huge financial loss.

Gather around, guys. Here’s the scoop.

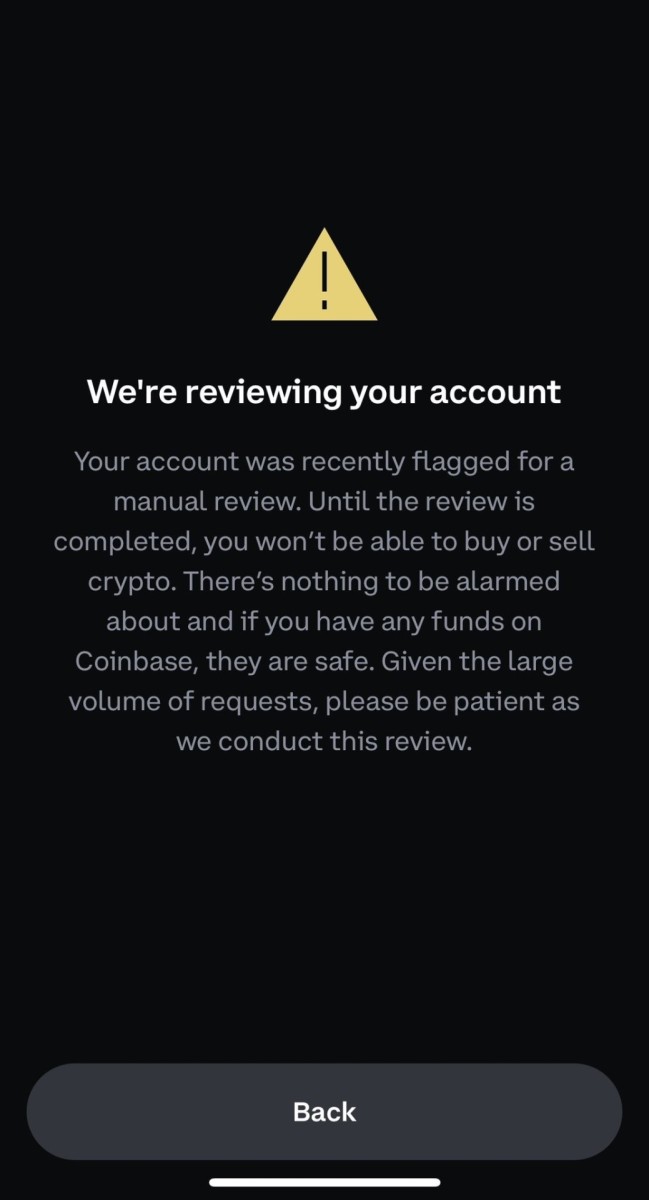

So on March 19, Weinstein engaged in two trades, not for long-term holds, but quick gains. Just a week later, these trades were racking up profits, but then, out of nowhere, Coinbase froze his account due to a pending KYC request. Marc has been with Coinbase for over a decade, but evidently, even long-standing customers aren’t exempt from these sudden account freezes.

Despite understanding the need for security checks, Marc found himself unable to access his account or close his open positions, which led to a rapid reversal of his gains—from over $50,000 in profits to a $50,000 loss.

Calling out @COINBASE 🚨🚨

— Marc Weinstein (@WarcMeinstein) April 12, 2024

Your KYC Policy has now cost me nearly 6 figures in 1 month.

OK, so here's the scenario:

On March 19th, I put on two trades (yes they were trades, not long term holds). These buys were very much in the money 1 week later; however, days after I made… https://t.co/sDH7YZ76Xj

His repeated pleas to Coinbase’s compliance team to manually close his positions were met with nothing but requests for more documentation.

“If the account is locked and all funds remain on the exchange, what is the issue with closing open trades?” he lamented, pointing out the financial bleed as the market trended downwards.

Marc also detailed his further attempts to resolve the issue, sending multiple emails to Coinbase, asking for permission to at least close some positions while his account review was underway. The responses were either further requests for information or silence. See the image he shared below:-

On March 28 and 29, Weinstein sent emails seeking help to close positions in two major cryptocurrencies, but the support was unresponsive regarding actionable solutions.

This incident has caused a wave of solidarity and shared frustration within the cryptocurrency community. Everyone’s favorite blockchain sleuth ZachXBT jumped in, vouching for Weinstein’s legitimacy and urging Coinbase executives to take a closer look at the case.

However, not all community members were hopeful. Ethan Kravitz expressed skepticism about any recourse, citing Coinbase’s Terms of Service and advising an even more public callout to get any response.

Other users shared their dismal experiences with Coinbase.

A crypto investor named Garrette recounted his months-long negotiation with Coinbase involving extensive documentation like seven years of tax returns, only to face ongoing delays. Another user, frustrated with the lack of responsiveness, recommended switching to more reliable platforms like Gemini or Kraken.

Grug, a high-volume trader, expressed his relief after moving to Kraken due to Coinbase’s unexplained account lock that lasted over a year with no resolution in sight.

R89 Capital and other users echoed these sentiments, describing Coinbase’s treatment of long-time, compliant users as criminal-like.

Oops!

The consensus in the community discussions was clear. There is A LOT of frustration with Coinbase’s customer service and policies, with many calling the exchange’s practices outdated, slow, and overly bureaucratic.

CEO Brian Armstrong, who has never been the crowd’s favorite person, was dragged through the mud alongside his company. Coinbase’s legitimacy and professionalism is increasingly being called into question.

Users are not only expressing their anger and trashing the exchange, but they are also actively moving to other platforms, showcasing dissatisfaction with how Coinbase handles customer relationships and trades.

Clearly, Brian and co’s current way of doing business just doesn’t cut it anymore. Though never the greatest strategists, it might be time to wake up and do right by customers. Fix their reputation. I mean, this is a highly-competitive industry. Get up, Coinbase!

From Zero to Web3 Pro: Your 90-Day Career Launch Plan