Ethereum-based crypto investment products have witnessed a negative outflow for the fourth week in a row. According to data from CoinShares, Ethereum saw a $22.5 million worth of outflow last week with most altcoins experiencing an opposite trend. The report found that other crypto-based investment products experienced positive inflows.

Ethereum-based investment products record negative outflows

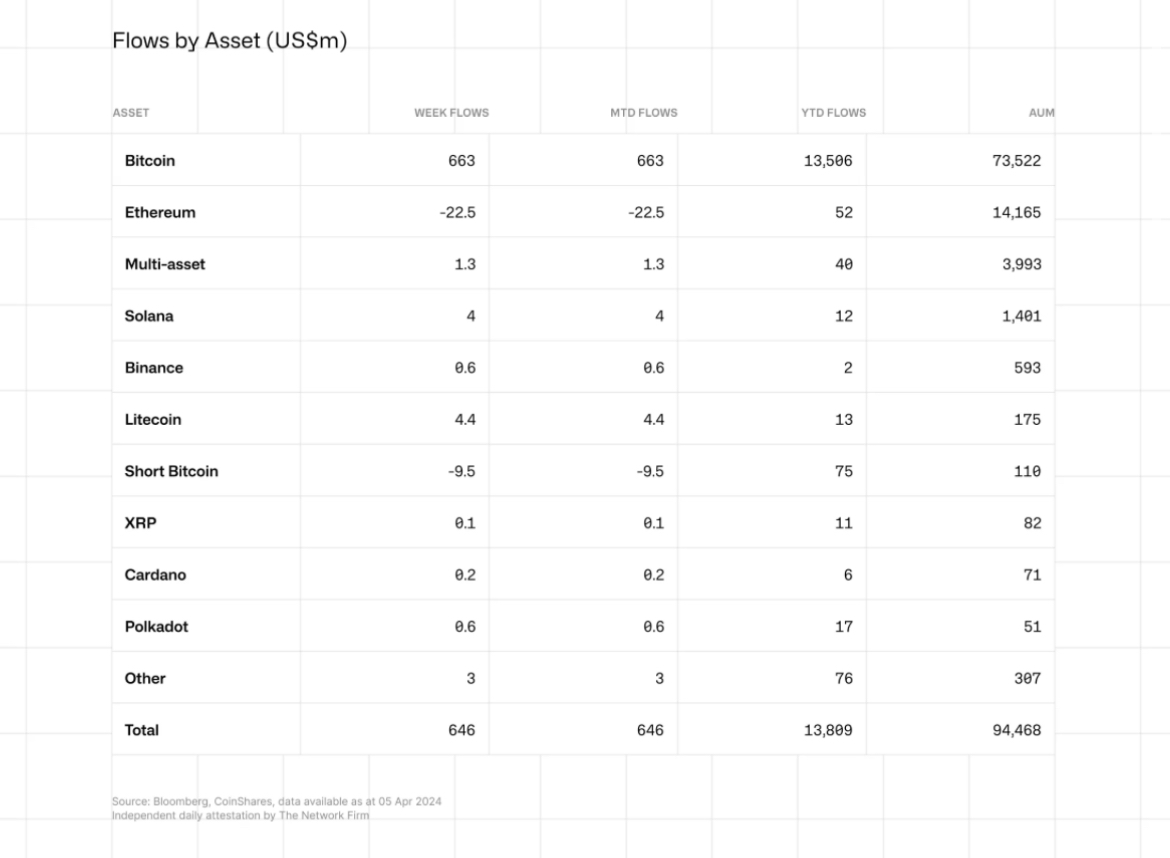

The report noted that there was a general positive sentiment in crypto investment products with inflows reaching $646 million last week. “Digital asset investment products saw continued positive sentiment with inflows totaling US$646m last week. inflows year-to-date at US$13.8bn are at their highest ever level,” the report said.

Ethereum witnessed its fourth consecutive week of outflows despite other altcoins seeing positive inflows. According to the report, Litecoin’s weekly inflow was around $4.4 million closely followed by Solana with a weekly inflow of $4 million, while Filecoin made the top 3 with a weekly inflow of $1.4 million.

Ethereum experiences a slight decline

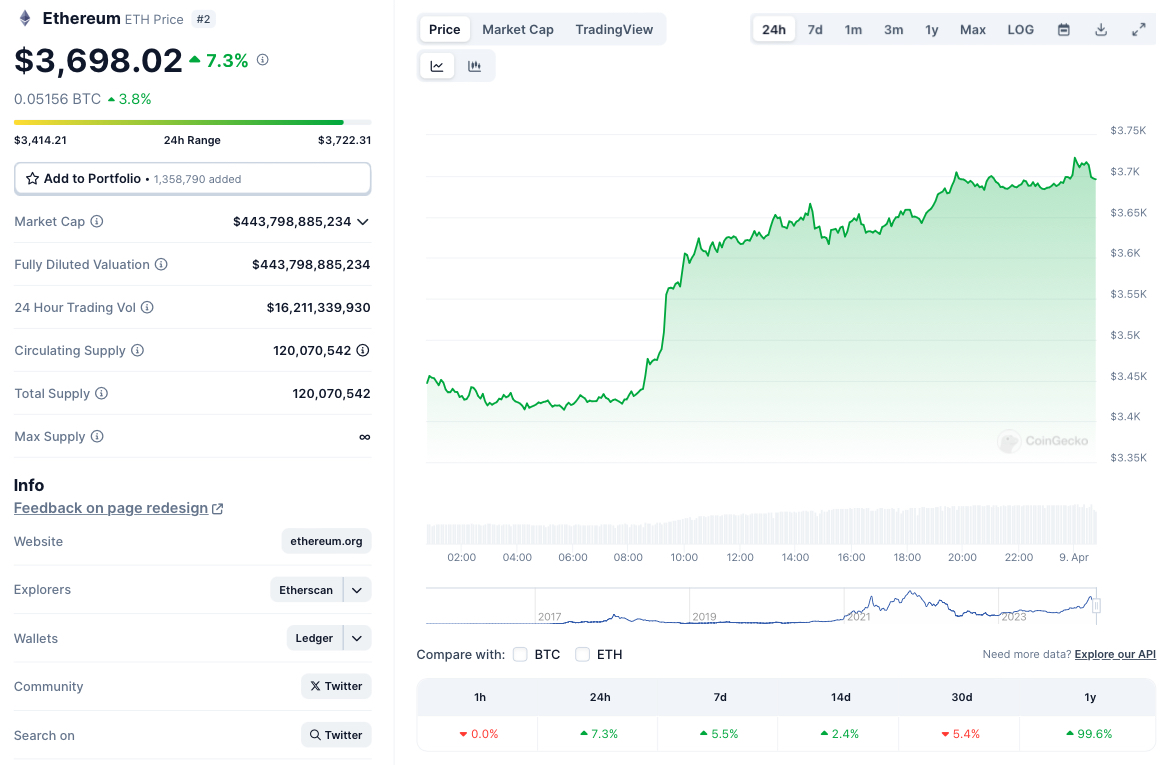

Ethereum experienced a slight rise of about 7% to trade at $3,698 over the last 24 hours. According to CoinGecko data, the asset is presently up by 5.5% on the week and down by about 5% in the past month.

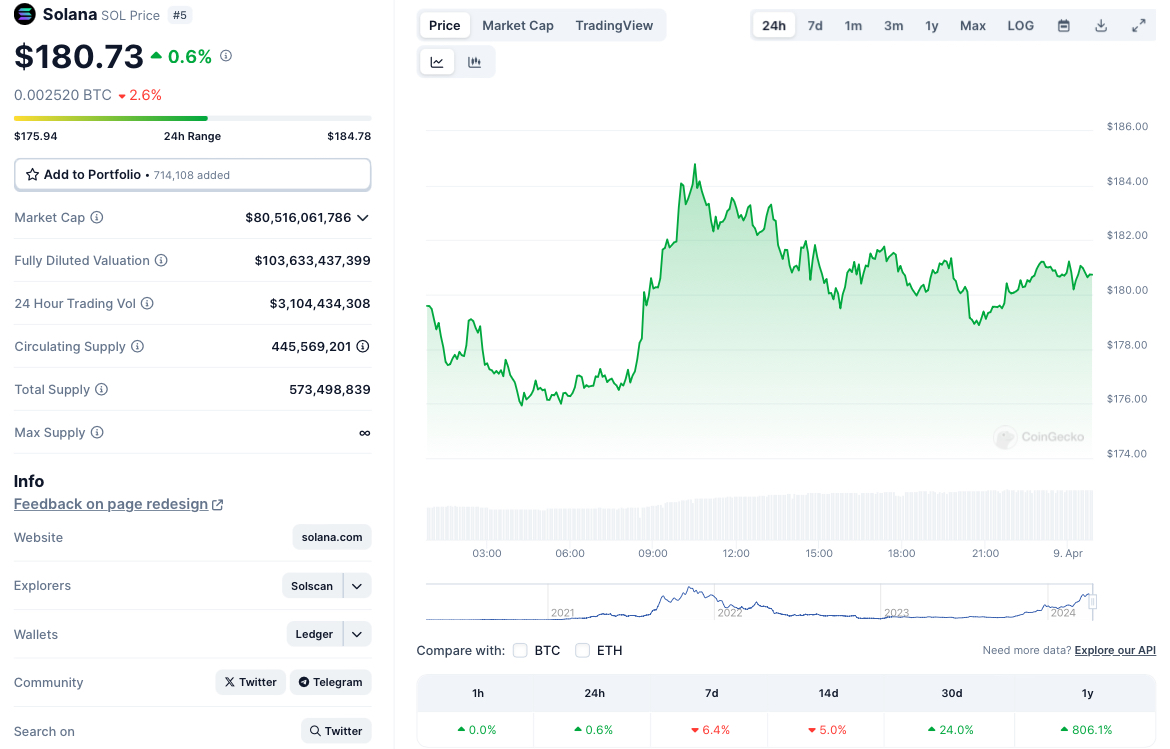

On its part, Solana has been tipped to become one of the most sought-after due to its scalability and high throughput. Its native token SOL has experienced a 24% rise in the last month whereas Ethereum experienced a drop of 5% in its value.

CoinShares believes that investor appetite for exchange-traded funds may be on the decline despite the massive $646 million worth of inflows into crypto investment products. “Despite this, there are signs that appetite from ETF investors is moderating, not achieving the weekly flow levels seen in early March, while volumes last week declined to US$17.4bn for the week compared to US$43bn in the first week of March,” CoinShares noted.

Since the approval of spot Bitcoin ETFs in January, over 834,000 Bitcoins worth $60.4 billion have been shifted into these funds. Data from Dune notes that ETFs have only accumulated about 4.24% of the total Bitcoin supply. CoinShares also noted that short Bitcoin investment products experienced outflows for the third consecutive week, with the outflow signaling a minor capitulation among bearish investors.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan