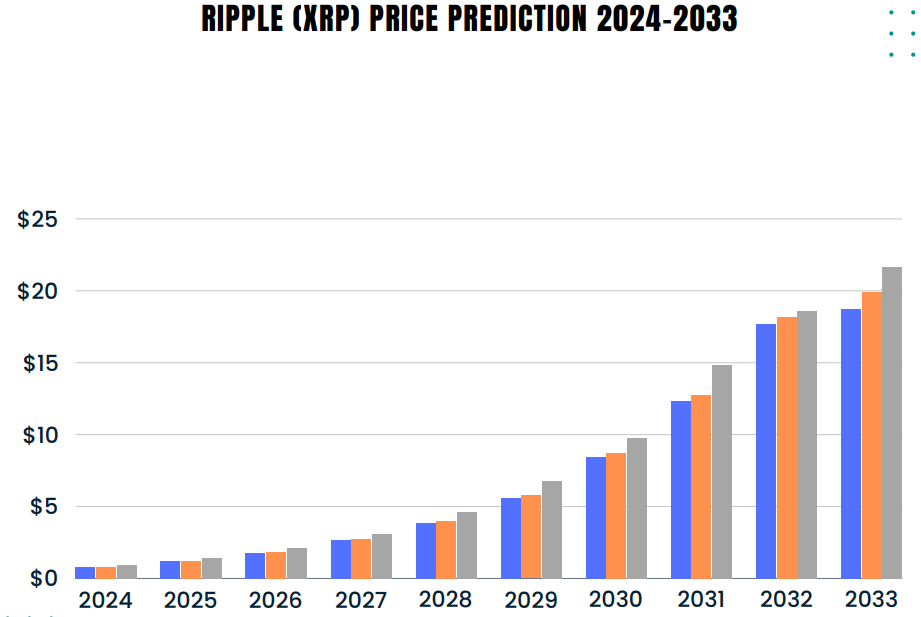

XRP Price Prediction 2024-2033

- XRP Price Prediction 2024 – up to $0.95

- XRP Price Prediction 2026 – up to $2.10

- XRP Price Prediction 2029 – up to $6.79

- XRP Price Prediction 2032 – up to $18.63

- XRP Price Prediction 2033 – up to $21.63

So LBRY lost its case against the SEC. Sad to say, the ruling still doesn’t provide regulatory clarity as to the definitive conditions (the essential ingredients) that establish an offered asset as a security. Especially when the Judge touches only on the third prong in this case. The 76-year-old Howey Test doesn’t seem quite helpful when applied to cryptocurrencies like XRP.

The problem becomes more apparent when we try to determine just exactly when XRPs can become ‘securities’ according to SEC’s argument.

If Ripple loses the lawsuit, trading will be suspended. While XRP funds will remain safely stored in your account after the trading suspension, you will not be able to buy, sell, or convert.

It’s only when the tide goes out that you know who’s been swimming naked.

Warren Buffett

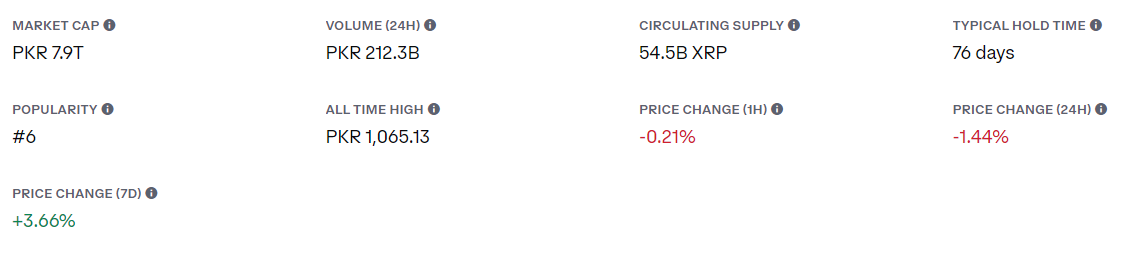

How much is XRP worth?

Today’s XRP price is $0.4963 with a 24-hour trading volume of $1,239,513,665. XRP is down 3.61% in the last 24 hours. The current CoinMarketCap ranking is #7, with a live market cap of $27,410,259,438 USD. It has a circulating supply of 55,235,913,166 XRP coins and a max. supply of 100,000,000,000 XRP coins.

XRP Technical analysis: XRP devalues to $0.497 after bearish slide

TL;DR Breakdown

- XRP price analysis confirms a downtrend.

- Coin value has dropped down to $0.497.

- Strong support is available on $0.464 end.

The latest one-day and four-hour XRP price analysis for 30 April 2024 indicates signs of a downward swing. The price movements have been in favor of the cryptocurrency sellers since the past week. In the past 24-hours, a further bearish turn in coin value was recorded as it deteriorated below $0.497 margin. Chances of further bearish trend seems near as the selling pressure is quite intense.

XRP price analysis on a daily timeframe: Decreasing trend continues as XRP drops to $0.497

The latest one-day XRP price analysis indicates a highly bearish scenario for the cryptocurrency today. The bears remained on the winning side this week with a few instances of bullish recovery. Because of the aggravating bearish activity during the last 24-hours, the cryptocurrency value has depreciated below $0.497 low. Side by side, the Moving Average (MA) value has dropped down to $0.524 as well because of the continual decline this week.

The volatility seems to be on the decreasing side which is a bullish signal for the coming future. Because of the declining volatility, the upper end of the Bollinger bands indicator has moved to $0.576. Whereby, the lower end of the Bollinger bands indicator has switched to $0.464. The Relative Strength Index (RSI) indicator confirms the declining momentum as its overall value has been reduced to 37.62.

XRP price analysis on the 4-hour chart: Cryptocurrency value hits $0.496 after revival

The recent four-hour XRP price analysis confirms a highly bullish scenario regarding the current market events. The bulls seem to have taken over the market in the past four hours once again. As a result of the abrupt bullish comeback, the coin value has received a significant recovery above $0.496 high. Side by side, the Moving Average value has experienced a decline below $0.506 because of the earlier downside.

The four-hour price chart dictates a rising volatility which is a bearish hint for the coming future. Because of the rising volatility, the upper end of the Bollinger bands indicator has switched to $0.528. Whereby, the lower end of the Bollinger bands indicator has moved to $0.494. The RSI graph displays an ascending curve as its overall value has climbed up to 34.66.

What to Expect from XRP Price Analysis

The latest one-day and four-hour Ripple price analysis depicts signs of a declining momentum. The selling pressure remained on the intense side once again as the latest bearish turn has resulted in depreciation below $0.497. Side by side, the four-hour price analysis depicts a bullish recovery because of the swift comeback in the past few hours.

Is XRP a good investment?

XRP, a cryptocurrency specifically tailored for rapid and cost-effective cross-border transactions, holds promise within the realm of global finance. Its utility in facilitating swift international money transfers positions it as a viable option for investors seeking exposure to this burgeoning sector. The extent of adoption by financial institutions, coupled with Ripple’s strides in forging strategic partnerships, plays a pivotal role in shaping XRP’s value trajectory. However, the decision to invest in XRP isn’t one-size-fits-all. While it may present an enticing opportunity for some, others may find it incompatible with their risk appetite or overall investment strategy. Ultimately, evaluating the merit of XRP as an investment hinges on various factors, including individual investment objectives, tolerance for risk, and the prevailing conditions of the cryptocurrency market.

As with any investment, the outlook for XRP remains subject to uncertainties, necessitating a cautious approach and thorough due diligence. Assessing its investment potential entails a careful consideration of one’s risk appetite and confidence in its sustained viability over the long term. Engaging in comprehensive research and potentially diversifying one’s investment portfolio can mitigate risks associated with XRP or any cryptocurrency investment. In navigating the dynamic landscape of digital assets, prudent decision-making informed by individual financial goals and risk preferences is paramount. Our XRP price forecast section provides analysis on the profitability of the coin in the coming years.

Recent News/Opinions on the Ripple Network

XRP Achievement: 59.8 Billion XRP Association Amongst 5 Million Holders. XRP has surpassed a massive feat as more than five million accounts have a net worth of 59.8 billion XRP assets, which signals a monumental rise in adoption as well as distribution. This massive outburst and trust has been the result of the latest regulatory clarity which rendered XRP as a non-security token. Side by side, investments from institutional ends have been noticed as part of the latest influx during the recent weeks. Because of these investments, XRP has unlocked a new milestone as it has achieved a recovery up to $0.628. The next target maybe $0.67, with an ultimate goal of $0.74, XRP seeks new highs in the crypto universe and promises potential for growth in future.

Ripple’s Unanticipated 400 Million Jackpot Sparks Debate. The San-Francisco crypto franchise, Ripple, has potentially unlocked a total of 400 million XRP tokens from its escrow account, valuing around $217 million of net worth. This achievement has sparked confusion in the crypto community, as the event took place around an unusual period. Because of a cryptic memo, the suspicions have gained strength, as it has remained unlikely in comparison to Ripple’s regular escrow releases. As a rigid schedule is followed during Ripple’s escrow release patterns, the recent schedule remained deviant leading to huge speculations amongst the cryptocurrency seekers.

Ex-Chief Executive Officer SEC’s Remarks on Ripple Case. The former SEC chairman has shared his stance on the ongoing legal battle concerning Ripple, signaling a future possibility of an appeal from both parties. According to his speculation, the oppositional parties including the SEC and Ripple might pose an appeal against the Judge Analisa Torres’s original verdict in the court. During an interview on the podcast “The Future of Money”, he reiterated the importance of regulatory distinction amongst security transactions for capital raise as well as secondary trading. He emphasized that the case’s final verdict is still a far fetched idea because of the repeated appeals and court petitions that have been going on since the beginning of the legal battle. With respect to crypto fundraising, his stance suggested that rigorous regulation is the key to capital raising. Amidst the lawsuit, XRP price keeps fluctuating, and it is currently at $0.51 as of 5th February.

Ripple Challenges SEC’s Alleged Mischaracterizations in XRP Lawsuit. In the ongoing SEC v. Ripple Labs lawsuit, Ripple has sent a letter to Magistrate Judge Sarah Netburn, seeking a sur-reply to correct what they claim are significant factual mischaracterizations by the SEC. Ripple disputes the SEC’s statements related to the burden of producing post-complaint contracts and the completeness of information provided in an ongoing class action suit. Pro-XRP attorney Bill Morgan expresses surprise at the SEC’s alleged mischaracterization. The legal battle revolves around the SEC’s motion to compel remedies-related discovery from Ripple.

XRP Price Predictions 2024-2033

Price Predictions by Cryptopolitan

| Year | Minimum | Average | Maximum |

| 2024 | $0.79 | $0.82 | $$0.95 |

| 2025 | $1.19 | $1.23 | $1.41 |

| 2026 | $1.80 | $1.84 | $2.10 |

| 2027 | $2.66 | $2.73 | $3.07 |

| 2028 | $3.86 | $3.97 | $4.62 |

| 2029 | $5.61 | $5.77 | $6.79 |

| 2030 | $8.42 | $8.71 | $9.79 |

| 2031 | $12.35 | $12.78 | $14.84 |

| 2032 | $17.70 | $18.21 | $18.63 |

| 2033 | $18.73 | $19.92 | $21.63 |

XRP Price Prediction 2024

Our Ripple price forecast for 2024 suggests the altcoin could trade at a minimum price of $0.79 and an average forecast price of $0.82. Ripple price could hit a maximum price of $0.95.

XRP Price Prediction 2025

The Ripple price forecast for 2025 is for Ripple cryptocurrency to trade at a minimum price of $1.19 and an average price of $1.23. The maximum forecast price for 2026 is $1.41.

XRP Price Prediction 2026

In 2026 our XRP price forecast for 2026 suggests Ripple cryptocurrency could reach a minimum price of $1.80 and an average price of $1.84. Ripple coin is estimated to reach a maximum price of $2.10.

XRP Price Prediction 2027

Ripple XRP price forecast for 2027 estimates a minimum value of $2.66 and an average trading price of $2.73. The maximum price forecast for 20227 is $3.07.

Ripple Price Prediction 2028

Our Ripple forecast for 2028 expects the price of 1 XRP to reach a minimum of $3.86 in 2028. The XRP price can reach a maximum level of $4.62, with an average price of $3.97 throughout 2028.

XRP Price Prediction 2029

The Ripple coin price prediction for 2029 estimates Ripple to attain a minimum value of $5.61 and an average price of $5.77, with a maximum price of $6.79.

XRP Price Prediction 2030

According to the Ripple price forecast for 2030, Ripple is predicted to hit a minimum price of $5.61 and an average price of $5.77 throughout the year 2030. The maximum forecasted Ripple price for 2030 is set at $6.79.

XRP Price Prediction 2031

The Ripple price prediction for 2031 suggests Ripple coin will reach a minimum value of $12.35 and an average price of $12.78, with a maximum price of $14.84.

XRP Price Prediction 2032

The Ripple coin price prediction for 2032 predicts the XRP to have a minimum price of $17.70, an average of $18.21, and a maximum price of $$18.63.

XRP Price Prediction 2033

The current XRP price prediction for 2033 suggests a minimum price of $18.73 and an average trading price of $19.92.Ripple cryptocurrency is expected to attain a maximum price of $21.63.

XRP Price Prediction by DigitalCoinPrice

DigitalCoinPrice’s bullish short-term prediction states that the XRP price will increase by 215.56 by the end of 2026. The current indicators indicate the bearish zone, and the fear & greed index shows 17.53 extreme fears, which means the price is currently stable. But if all factors turn favorable, a further surge in XRP prices towards the end of May is possible.

DigitalCoinPrice estimates the price of Ripple to reach a minimum of $1.49, an average trading price of$1.69, and a maximum forecast price of $1.79 by the end of 2026. For the long-term forecasts, Ripple is estimated to trade at a maximum value of $3.77 in 2030, while by 2032, the value of XRP is expected to reach a peak of $7.20.

XRP Price Prediction by Wallet Investor

Wallet Investor is bearish on Ripple price in the short-term forecast, stating that XRP can reach $0.46 by the 17th of April 2024. This is quite lower than the current value of $0.5800. In the one-year forecast, Wallet Investor expects XRP price to reach an average of $0.398 with a minimum and maximum price estimation at $0.37 and $0.724, respectively, by the end of 2024.

As per Wallet Investor’s investment advice, it terms Ripple as a bad long-term investment and predict that XRP will not be able to reach its all-time highs in the coming years.

XRP Price Prediction by Coincodex

Coincodex uses deep technical analysis for XRP price prediction to estimate it’s value on where the price is headed shortly. The team of analysts follows a range of indicators and technical analysis methods – from analytical models to fundamental analysis – to produce accurate Ripple price forecasts. According to Coincodex’s Ripple price predictions, the current value of Ripple could rise by 11.25% and reach $ 0.656 by May 3, 2024.

However, due to the current bearish sentiment in the market, as indicated by their technical indicators and Fear & Greed Index of 71 (Greed), now might not be the best time to invest in Ripple. Moreover, XRP recorded 16/30 (53%) green days with 3.70% price volatility over the last 30 days.

Coincodex’s long-term price predictions for Ripple suggest the price could reach $ 9.05 if it follows Facebook’s growth. If XRP followed Internet growth, the prediction for 2026 would be $ 1.148529. Also, based on the data from April 03, 2024, the general XRP price price prediction sentiment is bearish, with 8 technical analysis indicators signaling bullish signals and 21 signaling bearish signals.

XRP Price Prediction by Market Experts

Ripple price action in the previous few days saw XRP/USD riding high before plunging to the recent low. The XRP price forecast according to BULLRUNNERS market expert based on Youtube, Ripple is expected to break out of a long-term triangle, which could lead to significant gains shortly. He has predicted that Ripple could reach as high as $0.60 in the short term and possibly $1 in the medium term if it does not break out from its current levels. Finder concluded from a panel of thirty-six industry experts that XRP should be at $3.61 by 2025.

XRP Overview

Forecasts can change at the slightest notice

Looking at this overview, it is easy to see the high volatility of XRP’s price action in the past few months, which makes it difficult to have a Ripple forecast. But the volatility has not stopped analysts from making XRP predictions based on trends. It only means that these forecasts can change at the slightest notice. However, they still give a rough estimate of what to expect from them.

Given how past developments or even announcements have led to an increase in the value of XRP, the currency might reach $2. This will happen if the actions of Ripple technology lead to a partnership with more financial institutions.

In the past, XRP’s popularity and, by extension, its increase in value have been heavily influenced by the partnership with these traditional institutions. More partnerships will mean more adoption, which invariably means higher value.

However, it is not so simple for XRP. The SEC lawsuit complicates the whole issue even further. Before the SEC filed the case, the outlook for XRP was positive, even if it did not make many optimistic. But the lawsuit cuts its breakout short and makes a Ripple price prediction trajectory more challenging, unlike other digital currencies.

Considering how difficult it is to predict a digital asset accurately, it is even more difficult for XRP. After the lawsuit, more traders are acting bearish with the XRP cryptocurrency, raising fears that it could drop to below 10 cents. However, the price pump by retail investors and traders has allowed it to pick up again.

According to Coinpedia, even with the lawsuit hanging over its head, Ripple XRP will trade at an average of $20 in the next five years.

XRP Price History

Taking a lokk at XRP’s price history, for years after its creation, the coin’s value was so inconsequential that it was almost worthless. Before 2017, the asset’s value hovered around $0.01, but this soon changed as the token began to gain wider coverage, and it also leveraged on the bull run of the crypto industry in that year. By April 2017, XRP rose to $0.05; the gradual climb soon continued as it reached $0.25 in May showing a positive price action as Ripple continues to excel.

After this, there was no going back for the asset, as it had snared the attention of crypto enthusiasts who saw the value it created and the potential it had. The value of the asset rose all through 2017 and into the early period of 2018 when it got to an all-time high of $3.84.

Towards the end of 2019, its price stabilized at around $0.30 and did not cross the $0.5 mark throughout the year. This means that Ripple XRP hasn’t been able to build on its old glory since then, as its value never got to as high as even a dollar thus limiting its market cap.

However, the bullish run of 2020 that was ignited towards the end of the year helped the asset’s value to ascend. The token’s value got to as high as $0.8 before finishing the year at $0.66. Early 2021 was supposed to continue the rise in XRP value, but that could not happen due to the SEC’s announcement of a lawsuit with halted the XRP market cap growth.

The XRP price has been consolidating in a sideways channel since the crypto market crash in May 2021. The price has been consolidating between $0.56 and $1.39. The trend is currently neutral; however, it might retest the 0.618 Fibonacci level around $0.89 before moving to the upside. The Stochastic RSI for the daily time frame is also at the bottom (18); thus, there is a huge potential for the upside as far as there is no negative news in the crypto space.

In 2021, XRP prices surged, but by 2022 they plummeted significantly. As of February 4, 2024, an XRP token was valued at 0.50 U.S. dollars, while Ethereum continued to set new all-time highs, unlike XRP. The price spikes for XRP came comparatively later, marking a distinct trajectory from Ethereum’s consistent growth.

Also, there is a flat volume. This indicates that the supply from sellers and the demand from buyers are in equilibrium.

More on the Ripple Network

What’s XRP?

In the world of cryptocurrencies, XRP is quite different. It is decentralized, but not as much as Bitcoin, Ethereum, and the like. Unlike them, it doesn’t seek to be an alternative to the traditional banking system but rather to collaborate and improve the conventional banking system. Nonetheless, it is a cryptocurrency that could outlast others due to its many distinctive features and landmark developments.

What’s the Liquidity Hub

According to the official statement shared by Ripple, its liquidity hub is now officially open for business. After an extensive stress-testing campaign, it is ready to onboard the first generation of users. The first iterations of the liquidity hub will support Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Ethereum Classic (ETC), and Litecoin (LTC), as well as fiat currencies like the U.S. Dollar (USD).

This development only means one thing, Crypto is Good Investment Business. The future is bright for innovative #crypto applications, with the potential to:

- Simplify real-time secure money transfers

- Streamline back-office reconciliation

Find out how your business can unlock immediate, real-world value through crypto and blockchain with Ripple Liquidity Hub. https://on.ripple.com/3KEwHPI

The 76-year-old Howey Test doesn’t seem helpful when applied to cryptocurrencies like XRP. Quite likely because each XRP is indistinguishable from another XRP, as one pundit pointed out. Indeed, there’s LBRY CEO Jeremy Kauffman warns that the court decision “threatens the entire U.S. cryptocurrency industry” by setting a standard that would deem “almost every cryptocurrency” a security.

A notable development as a turnkey solution for financial institutions, Ripple Liquidity Hub will leverage smart order routing to source digital assets at optimized prices from market makers, exchanges, and OTC desks. As a crypto liquidity platform built for the enterprise, it will unleash the potential to access deep liquidity within cryptocurrency market, accelerating the shift to crypto.

Ripple Liquidity Hub will initially support BTC, ETH, LTC, ETC, BCH, and XRP (availability will vary by geography), with plans to add additional digital assets over time. Ripple plans to add functionality such as staking and yield-generating functionalities in the future.

Can XRP reach $1 soon? Why not? As the community pushes for action: It will be good to see this snowball! Next up, 40% in a year!

SEC vs. Ripple: XRP Price Prediction After Lawsuit

The lawsuit against Ripple has significantly hindered the price surge during this bull market. Even though the Securities and Exchange Commission (SEC) does not consider Ethereum and Bitcoin, which have similar characteristics as XRP, to be securities, the SEC has continued to be harsh towards Ripple Labs, Inc.

The XRP price fell by 70% immediately after the suit was filed and has never been able to break its previous all-time high of $3. XRP holders have been affected as major crypto exchanges like Coinbase, and Crypto.com suspended trading, so they couldn’t cash out. JP Morgan’s North America Equity Research also published a report earlier this month stating that the XRP asset is poised for significant adoption.

Keep updated with this unfolding data of SEC versus Ripple, which could topple the market if the predictions go south.

XRP Distinctive Features

Ripple has been in existence for a while. It was created in 2004 as RipplePay, but the case of its innovation came too early for its time, as it made no significant mark then. However, it returned in 2012 as Ripple and launched the XRP token soon after. Ripple XRP is unlike any other cryptocurrency. XRP is a product of Ripple Labs, and it differs on many levels, and this includes:

Ripple is not blockchain-based

Unlike most of the cryptocurrencies in existence, the coin does not operate on blockchain technology. Instead, it is based on the Ripple Protocol Technology, which means it has no use for a distributed ledger database. This uses gateways linked to servers of the company in multiple countries to verify and process transactions.

XRP cannot be mined

While the mining process is considered an integral part of all tokens, it is not the same for XRP. The limit for XRP coins is set at 100 billion coins created by the company. Over 35% of that coin has been released into the market. The rest is held by the company that releases it periodically to control the supply and circulation of the token. The cryptocurrency is a deflationary one as the number of coins in the market reduces with each transaction.

Is the Ripple network centralized?

According to the report, Ripple’s milestone is significant because it disproves claims that the Ripple network is centralized.

Technically, the virtual asset is centralized, and its parent company, Ripple Lab, strives to create partnerships with traditional financial institutions like banks. The company sells its RippleNet technology to these institutions, thereby increasing the popularity of its native token, Ripple XRP. RippleNet technology is a system that connects banks and facilitates cross-border payments and settlements.

Due to the differences between Ripple XRP and other cryptocurrencies, it also has some advantages. Some of them are:

- Fast transaction speed

This is one of the most significant selling points of Ripple technology. The swiftness of transactions surpasses other cryptocurrencies and beats that of SWIFT wire transfer, the commonly used system in traditional banking. This makes it a better alternative for banks to facilitate cross-border payments, as its XRP transactions are exceedingly fast. The ripple transaction protocol is quite efficient too.

- Low cost

Traditional banking system transactions and that of some cryptocurrencies tend to incur hefty transaction fees. But with digital currency, this fee is drastically reduced to a pittance.

- Reversibility of transactions

Another positive for it is that the transaction can be reversed or edited to deal with an error if there is one.

All these features have enabled the Ripple network to gain significant partnerships among traditional financial institutions. And it has also influenced the growth in the value of Ripple XRP over the years.

Growth in South Pacific

It is a fact that the recent partnership of Ripple with the Japanese payment giant SBI has brought the attention of various technical corporations across the South Pacific region, and it is expected that the entire region will see an expansion and adoption of Ripple tech.

It has been said that the Ripple remittance deal is setting the stage for the much broader adoption of Ripple. The lawsuit on Ripple about its security doesn’t seem to bother Japanese regulators or SBI officials.

Is XRP a security?

Specifically, the SEC claims that XRP is a security whose offer and sale can be made only pursuant to a statutory prospectus and an effective registration statement and that because Ripple did not file a registration statement its investors have a rescission right.

“Cryptocurrency” means “a digital asset implemented using cryptographic techniques designed to work as a medium of exchange.” As important as that definition is, more critical is what “cryptocurrency” is not—it is neither a security nor a commodity, both of which are separately defined.

The Responsible Financial Innovation Act introduced on 7 June 2022 includes a comprehensive regulatory framework for digital assets and seeks to provide clarity on how digital assets, such as cryptocurrencies, are treated under US securities law. The lynchpin of the bill is the codification of the US Supreme Court’s decades-old standard for determining when a financial offering is a “security,” i.e., the Howey test.

If cryptocurrency is a “security,” then crypto-companies issuing them must comply with Securities and Exchange Commission rules for registration and reporting—failure to do so can lead to significant penalties, such as the $100 million SEC fine. issued by the SEC in 2021.

However, many in the industry believe that cryptocurrencies act more like commodities than securities and would prefer them to be treated as such, subject to the Commodity Futures Trading Commission’s rules. The “security” vs. “commodity” debate has many practical implications for the cryptocurrency industry and consumers and is already heating up in Washington.

Those thinking about policy in the digital asset, cryptocurrency, and web3 industries would be well served to understand the rules that public officials already are subject to when handling digital assets of their own. See the discussion here.

There are over 220,000 XRP holders, but the top 10 holders control over 70% of the current XRP supply. Right now, cryptocurrency exchange Binance stores the most XRP, with its users holding over 30% of the current XRP supply.

Conclusion

XRP has been one of the most popular digital currencies in recent years, seeing a surge in popularity and adoption. Many market experts have positive outlooks on XRP and believe it could reach new heights in the future. Ripple’s Q2 profits report revealed that even with XRP’s price dropping, the demand for their On-Demand Liquidity service increased ninefold yearly. ODL sales totaled an impressive $2.1 billion in Quarter 2 alone! Furthermore, Ripple is putting its money where its mouth is by pledging a generous $100 million to invest in carbon removal activities as part of its responsibility to maintain environmental sustainability objectives and remain carbon neutral.

According to Ripple’s Crypto Trends report, Non-Fungible Tokens and Central Bank Digital Currencies are still in their infancy. As these two technologies manifest their true potential, their influence on Ripple’s network and the entire blockchain space will become apparent.

XRP’s future looks bright based on the opinion of industry experts. Ripple technology and products have enthusiastic backing from developers, supporters, and strong believers in its long-term potential. All signs point to XRP as having a secure footing for continued success.

Generally, experts are optimistic about XRP’s future growth and predict potential gains in the coming years. However, there could be some short-term price changes in the future. A strong community will help XRP succeed in the long run. In addition, several other factors have an impact on its future performance.

One of these is increased developments within Ripple’s products. For example, The XRP Ledger has been developing its own sidechain, which has just started to go through testing. Due to its compatibility with the Ethereum Virtual Machine, the sidechain aims to increase the interoperability of the blockchain (EVM). This enables programmers to use the Ripple Ledger to execute Ethereum smart contracts.

But this sidechain is a lengthy undertaking with three phases. The second stage, which will let any developer join the network, will start in early 2023 and become online in the year’s second quarter.

Recently, Ripple released its Q3 markets report. This indicated that, for the first time, the company’s XRP holdings were less than 50% of the overall supply. Ripple’s net acquisitions, meanwhile, were reported to have decreased by roughly $100 million from the prior quarter. However, this hasn’t impacted the overall XRP supply, as its price continues to increase.

There are several reasons why experts believe that XRP’s future performance is promising. For one thing, a strong community of supporters and developers continues to see tremendous potential in Ripple’s technology and products. Despite some short-term price fluctuations and a bear market, many analysts believe XRP has a bright future ahead. Whether it will reach new highs or continue to grow steadily remains to be seen, but there is no doubt that this crypto asset will continue to play an important role in global financial institutions.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan