Republic First Bank has officially been seized by U.S. regulators, making a big blow to the regional banking sector. This decision by the Pennsylvania Department of Banking and Securities came after the bank, based in Philadelphia, pulled out of import funding discussions with a group of investors.

The Federal Deposit Insurance Corp (FDIC) has appointed Fulton Bank, a unit of Fulton Financial Corp, to take over nearly all deposits and assets of Republic Bank, the operational name for Republic First.

Turbulent Times Lead to Bank Takeover

This takeover comes in a time of turmoil for Republic First, which reported having about $6 billion in total assets and $4 billion in deposits as of January 31, 2024. The FDIC estimates the cost to their insurance fund from this failure will hit around $667 million.

Besides deposits, Republic First also had about $1.3 billion in borrowings and other liabilities. With the acquisition, Fulton Bank will nearly double its presence in the Philadelphia market, boosting its combined deposits to approximately $8.6 billion.

Curt Myers, Fulton’s Chairman and CEO, expressed enthusiasm about the expansion, stating, “With this transaction, we are excited to double our presence across the region.” This strategy will see Republic Bank’s 32 branches across New Jersey, Pennsylvania, and New York reopening under the Fulton Bank banner, starting as early as Saturday during regular business hours.

Financial Struggles and Market Reactions

Earlier attempts to stabilize Republic First involved striking a deal with an investor group that included prominent figures like businessman George Norcross and attorney Philip Norcross. However, these efforts fell through by February, leading to the FDIC resuming control to sell the bank.

The Wall Street Journal was the first to report this development. Amid financial pressures and an unprofitable run, Republic Bank had already slashed jobs and exited its mortgage origination business in early 2023.

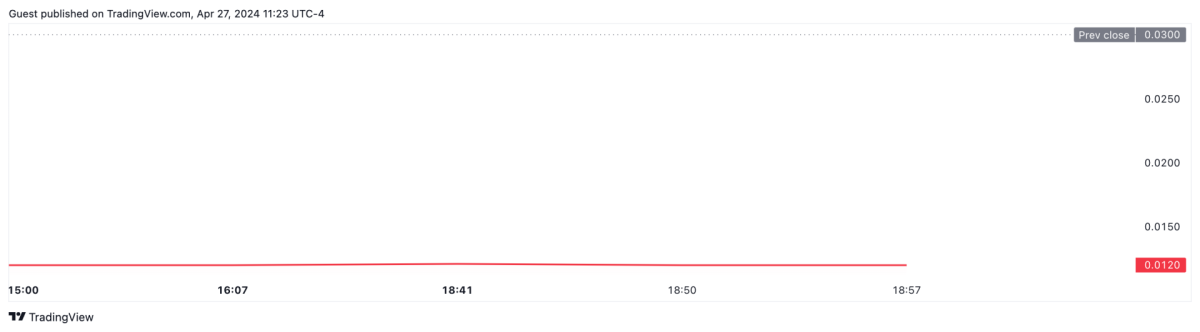

The stock price for Republic Bank plummeted from just over $2 at the year’s start to about 1 cent on Friday, reducing its market capitalization to under $2 million. Following its delisting from Nasdaq in August, its shares transitioned to over-the-counter trading.

This latest incident is part of a larger pattern affecting regional banks, made worse by rising interest rates and declining commercial real estate values. These challenges are particularly acute for office buildings, which have seen an increase in vacancy rates post-pandemic. Loans secured against devalued properties have become increasingly difficult to refinance, posing major risks.

The collapse of Republic First Bank is the first FDIC-insured institution to fail in the U.S. this year, with the last such incident occurring in November when Citizens Bank in Sac City, Iowa, closed its doors. In a typical strong economy, only about four to five banks are expected to fail each year.

Meanwhile, other banks are also feeling the heat. Last month, a rescue plan involving more than $1 billion was set in motion by an investor group, including former U.S. Treasury secretary Steven Mnuchin, to save New York Community Bancorp from the impacts of a weak commercial real estate sector and challenges related to a recent acquisition of a distressed bank.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap