The economic dance floor has never been more intriguing, with major world powers moving to the rhythms of finance and strategy, directly influencing the global dominance of the U.S. dollar. The BRICS is gaining momentum in their quest to cut ties with the U.S. dollar, potentially reshaping global economic supremacy.

De-dollarization Dreams of BRICS

This push towards abandoning the U.S. dollar in international dealings is not just a fleeting whim but a strategic plays rooted deeply in the BRICS countries’ long-term economic plans. The bloc is actively seeking to enlarge its membership, inviting new countries to join in their movement towards using a BRICS currency or other local currencies instead. This expanding influence in trade and geopolitical matters signifies a possible shift in global power dynamics, challenging the U.S.’s economic clout.

The allure of joining BRICS extends to numerous nations, intrigued by the bloc’s commitment to reshaping global financial infrastructure. This growing alliance represents over 40% of the global population and contributes about a quarter of the world’s GDP.

Their economic growth rates are currently eclipsing those of the U.S., which struggles with inflation and seesawing economic indicators. The shift in global trade patterns, favoring the BRICS nations, could further erode the U.S. dollar’s hegemony and by extension, impact the U.S. economy and its burgeoning national debt.

China, a major player within BRICS, boasts a significant trade surplus with the U.S., essentially selling more to America than it buys. This relationship feeds the U.S. trade deficit, effectively increasing the national debt as more dollars flow out than come in. Similarly, Brazil and India, as vital trade partners with the U.S., hold considerable sway over America’s trade balance and debt levels through their economic policies and trade flows.

Forecasting Fiscal Futures

As the U.S. grapples with escalating national debt, the forecast isn’t looking particularly sunny.

The Congressional Budget Office (CBO) predicts that by 2054, the U.S. national debt could reach a dizzying $141 trillion, which would be a staggering 166% of the projected GDP of $85.2 trillion. This exponential growth in debt is primarily driven by soaring interest costs and persistent deficits that exclude net outlays for interest.

Looking closer at the fiscal forecast, debt held by the public is expected to peak in 2029, reaching the highest level ever relative to GDP, before continuing its upward trajectory. This monumental debt will likely slow economic growth, inflate interest payments to foreign debt holders, and present significant risks to both the fiscal and economic outlook of the U.S. It might also limit the flexibility of future lawmakers in their policy-making decisions.

Government spending, already high by historical standards, is only expected to rise, reaching 27.3% of GDP by 2054. This increase is driven by growing costs associated with major healthcare programs, particularly Medicare. On the revenue side, despite fluctuations over the next decade, there’s an anticipated increase, with income growth expected to boost receipts from individual income taxes.

Economic Adjustments and Insights

The U.S. economy’s growth prospects are tempered by slower population growth expected over the next three decades. Without a boost from immigration, the population could even start to decline by 2040. The economy’s growth is also likely hindered by slower labor force growth and subdued capital accumulation, exacerbated by high levels of federal borrowing.

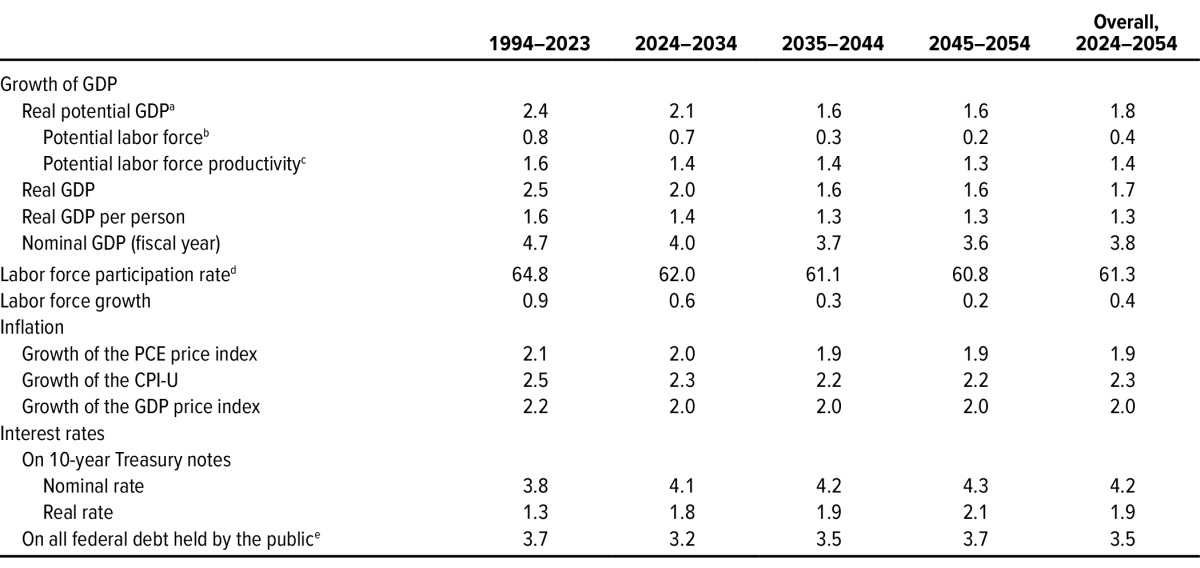

Despite a grim long-term outlook, inflation is projected to decelerate, aligning with the Federal Reserve’s long-term target of 2% by 2026 and stabilizing thereafter. Interest rates are set to rise, influenced by increasing federal borrowing needs and a growing proportion of capital income relative to total income.

These fiscal dynamics reflect adjustments from the CBO’s earlier projections, suggesting a somewhat less dire financial scenario than previously anticipated. This stems from a combination of lower discretionary spending due to legislative caps and an optimistic outlook on immigration boosting the potential labor force.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.