Recent data on America’s inflation this March delivered a gut punch to any lingering hopes of an early Federal Reserve rate cut. This development is a blow to the Democrats, as high interest rates could sour voter sentiment regardless of how the US economy grows.

The futures markets had been mildly optimistic, hinting at one or possibly two rate cuts later this year. However, monetary policy could swerve unexpectedly. Economist Larry Summers suggests a 15 to 25 percent chance that rates might actually go up. Summers also quipped about his new beard, which he could shave off in one go, possibly mirroring his hopes for a simple solution to complex economic problems.

Inflation Trends and Their Political Implications

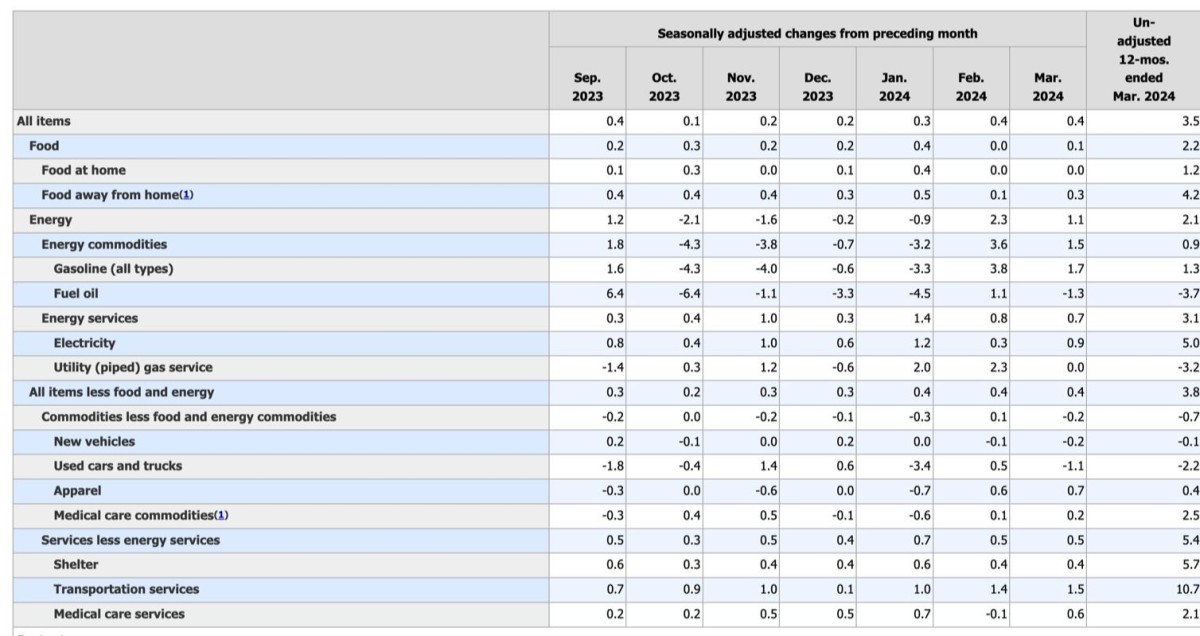

March’s core inflation rates, crucial for gauging economic stability, have veered off target, now standing at 3.8 percent—nearly double the Federal Reserve’s goal. Fed Chair Jay Powell faces a tough scenario, as the potential economic policies of a future Trump administration could further stir inflation through measures like mass deportations and new tariffs. Ironically, a few rate cuts might help Biden in the upcoming election by easing economic pressure, though the Fed maintains its nonpartisan stance fiercely.

Despite some economic gains, the everyday American feels the pinch. Inflation may have cooled from two years ago, and a recession was dodged, but that’s cold comfort for those unable to afford their own home, still living with parents, or crammed into shared spaces. Lower interest rates would directly improve their situation, yet the broader concerns about democracy’s future under a potential Trump presidency don’t resonate with most voters, dismissed as alarmist.

Polls reflect this disconnection. A recent Financial Times-Michigan Ross poll shows a preference for Trump over Biden on economic matters across various demographics, regardless of an uptick in the economy. The issues of abortion and immigration also play into voter preferences, with Trump gaining the upper hand on immigration, a critical factor for many voters.

Economic Forecasts and Uncertainties

Last year’s dire predictions of a recession have proven unfounded. Economists initially expected multiple rate cuts this year, a number drastically reduced over time. Now, expectations for rate cuts have bottomed out, signaling that economic forecasts remain highly unpredictable.

At an Investopedia economics live blog, it was noted that although consumer sentiment dipped slightly, inflation remains a significant concern, with the money supply as a telling indicator. Kim Caughey Forrest of Bokeh Capital Partners highlighted that the money circulating, which stood at $2.34 trillion in March, provides insights into potential inflation trends.

Susan M. Collins of the Boston Fed commented that the path to the 2% inflation target is longer than expected, suggesting rate cuts might be pushed back. While she remains optimistic about eventually lowering rates, she admits the timing is uncertain and dependent on unfolding economic data.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan