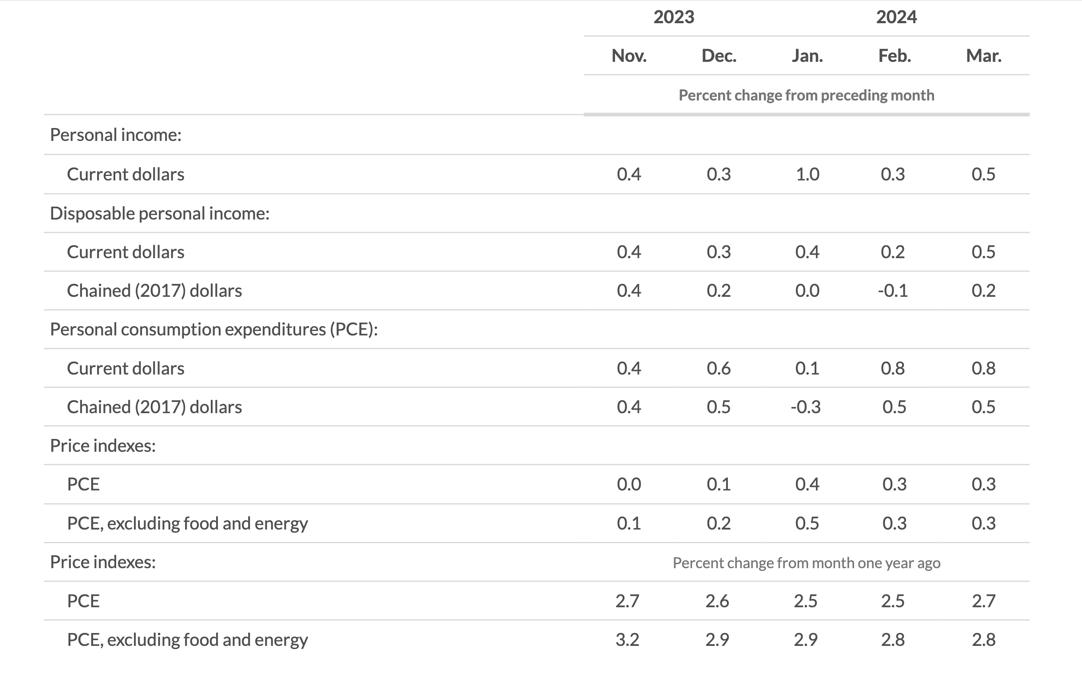

Inflation’s grip didn’t loosen up in March. The Federal Reserve keeps a close eye on the personal consumption expenditures (PCE) price index. This month, it didn’t bring any relief. The Commerce Department spilled the beans on Friday, revealing that the core PCE (that’s the one without food and energy costs) was up 2.8% from last year. That’s the same as February’s figure and a tad higher than what folks expected.

Tack on food and energy, and you get the all-items PCE clocking in at 2.7%, just a notch above the forecasted 2.6%.

Market Shrugs Off the Persistent Inflation

The markets didn’t make much of a fuss about this. Wall Street looked set to kick off higher, even though the Treasury yields took a slight dip—the 10-year note dropped by about 0.4 percentage points, settling at 4.67%. It seems some folks are betting on the Fed to slice rates twice this year, with odds ticking up to 44%.

George Mateyo, the big brain at Key Wealth, wasn’t too shaken. He warned that while the inflation heat wasn’t as scorching as feared, no one should think it’s all chilled out and the Fed’s just gonna slash rates soon. He thinks the Fed will want to see the job market take a hit before they get bold with cuts.

Spending Steady Despite Price Hikes

Consumers aren’t slamming their wallets shut yet. They forked out 0.8% more on goods this month, a hair above what was guessed. Personal incomes also saw a 0.5% bump, which is pretty much what everyone figured would happen. But hey, it’s better than last month’s 0.3% increase.

However, the personal saving rate isn’t looking too hot. It fell to 3.2%, down from 3.6% last month and way lower than last year’s rate. It looks like folks are digging into their savings to keep up with their spending habits.

Yesterday’s downer from the Commerce Department showed that the PCE sped up to a 3.4% annual rate in the first quarter while the GDP only grew 1.6%, way below what Wall Street was hoping for. This kind of news probably means the Fed’s gonna keep interest rates steady at least through the summer unless something big changes.

Inflation has been a real pain for over two years now, hitting levels not seen in over four decades. The Fed’s got its eye glued on these numbers, figuring out their next move.

They’re shooting for 2% inflation, but it’s been hovering above that for three years now. The Fed prefers the PCE since it adjusts for how people switch up their spending and doesn’t weigh housing costs as heavily as other indexes.

This month, service prices were up by 0.4%, but goods barely budged, up just 0.1%. Looks like the big price hikes have shifted from goods to services since the pandemic started. Food prices dipped by 0.1%, but energy shot up 1.2%.

Over the past year, service prices have climbed 4%, goods prices are stagnant with just a 0.1% increase, food’s up 1.5%, and energy has risen 2.6%.

Overall, U.S. inflation ticked up to 2.7% for the year to March. Friday’s numbers were a bit of a surprise since they were higher than the expected rise from 2.5% to 2.6% in February. The core PCE stuck at 2.8%, despite predictions it might drop to 2.7%.

Yesterday’s report on first-quarter inflation and growth kicked the can down the road for rate cut hopes. Traders now see the first rate cut happening in November, right after the presidential election. This is a tough break for Biden, who’s trying to show he can wrestle down inflation.

Borrowing costs are at a 23-year peak, with the PCE index staying above the Fed’s 2% target since March 2021. Looks like it’s going to be a long haul with these inflation numbers.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.