TL;DR Breakdown

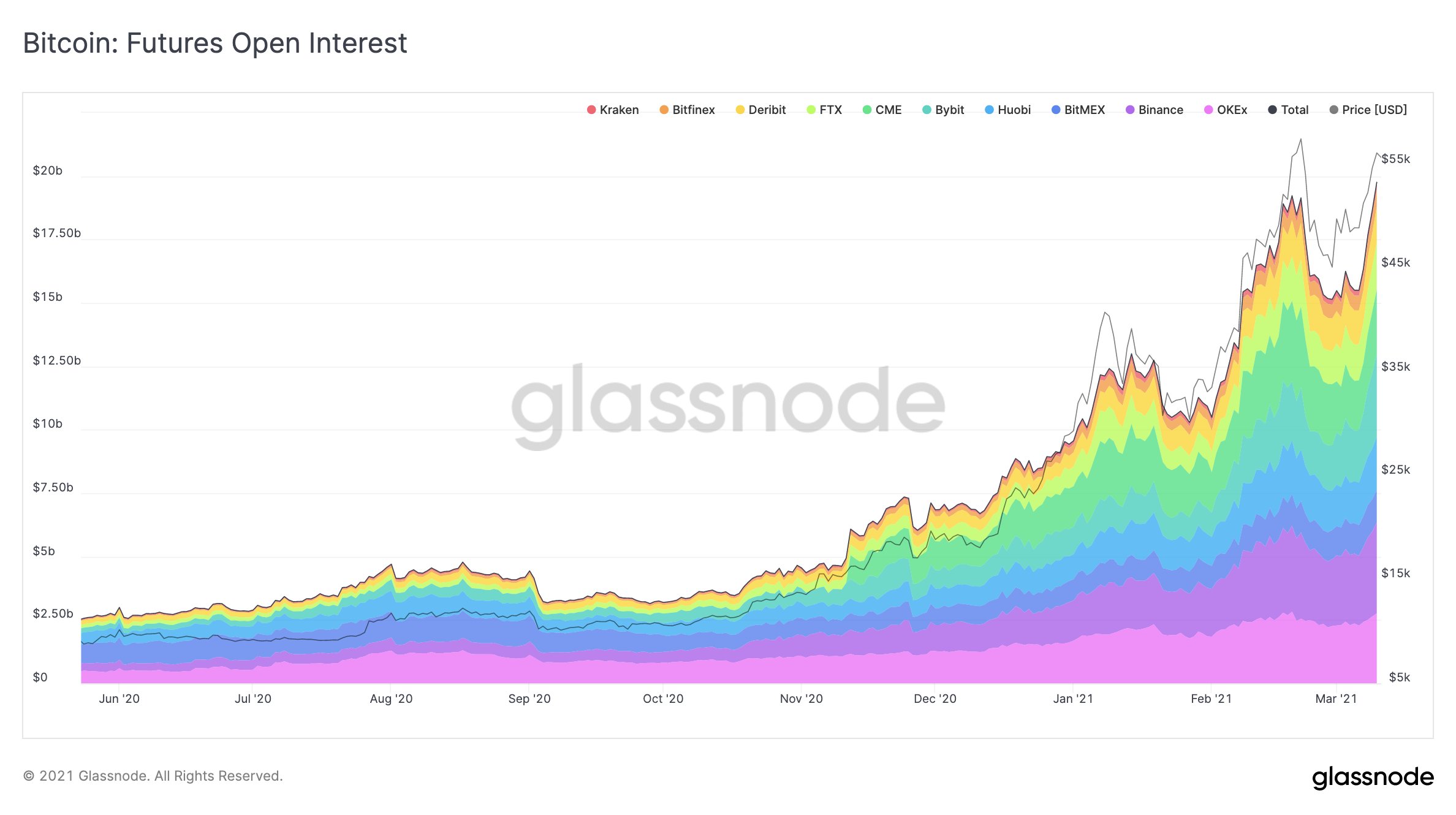

- Open interest in Bitcoin futures has reached another all-time high, signaling more capital inflow in the derivative market.

- This is coming as Bitcoin reclaimed a market price above $50,000.

The recent correction in Bitcoin (BTC) also caused a massive drop in several other related products. As Bitcoin retraced to around $43,000 in February, the derivative markets also went down, forcing many over-leveraged traders out of the futures market. However, as the price of the cryptocurrency claimed over $50,000, more capital is beginning to flow into the market again, especially in Bitcoin futures.

This is evident as the value of open interests in Bitcoin futures is currently on the verge of the $20 billion marks, which means the amount of outstanding Bitcoin futures contracts is already at an all-time high (ATH), as per Glassnode, a crypto analytics platform.

Open interest in Bitcoin at ATH

A glance at ByBt revealed that the open interest in Bitcoin futures is currently worth over $19.6 billion, which represents about 359.17k BTC. This is a 3.24 percent increase over the past 24 hours. Binance leads other derivative exchanges with a total valuation of $3.48 billion in open interest. Other leading exchanges include Bybit ($3.19 billion), OKEx ($2.74 billion), CME ($2.43 billion), and Huobi ($2.12 billion).

There is always an increase in the open interest in Bitcoin futures whenever the cryptocurrency surges. In January, the amount of outstanding Bitcoin futures contracts surged to a previous ATH of $12 billion, as Bitcoin surged above $30,000. Similarly, the increasing inflow in Bitcoin futures comes as the price of the cryptocurrency returned to over $50,000. During press time, Bitcoin was trading at $54,795 on Coinmarketcap.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.