Investors and financial analysts are bullish on AI as the week witnessed interesting movements in the tech stocks, mainly triggered by heavy pledges by big brand names in artificial intelligence. Microsoft, Google, and Meta seem powerful candidates, with Nvidia leading the pack, while Meta saw a momentary dip of 19% in its shares after the announcement of heavy investments in AI infrastructure, which washed off $200 billion of the company’s market cap.

At the same time, Nvidia saw a 17% spike in its stock in just five days, so we can say that now we have trillion dollar stocks that are as volatile as penny stocks. Well, crypto is not an interesting investment alone anymore, considering the wild fluctuations. But there is more to it than these momentary price movements with far more greater impact, let’s explore.

Microsoft performs better than expected and leaves Google behind in AI

When Microsoft announced its 2024 Q1 earnings, and they were higher than what Wall Street was expecting, and the company’s stock surged on Friday.

Their earnings report highlights the company’s unique position in the AI industry, as being OpenAI’s biggest investor, it has an edge over the competition. It said there is high demand for its AI services, which contributed to the performance of its Azure cloud business, which showed better than expected results.

Microsoft management has a clear vision of the future for substantial growth in revenue from their cloud service offered through Azure, noted analysts from financial research and investment management firm Bernstein. One of their analysts noted,

“We also see this as an indicator that Microsoft has taken the AI mantel from Google and that Azure could become a bigger and more important hyperscale provider than AWS.”

He further added,

“If this trend continues, then AI will be a very large driver of the size of Azure’s long term revenue and will require re-evaluation up of how big Azure could be.”

Source: Marketwatch.

The financial firm’s analyst, Mark Moerdler, said in his recent review that Microsoft is a solid company and should be in your portfolio as it has multiple arms to fetch revenues.

According to Amy Hood, Microsoft’s chief financial officer, their capital expenditure will increase over time in order to meet the high demand for generative AI services.

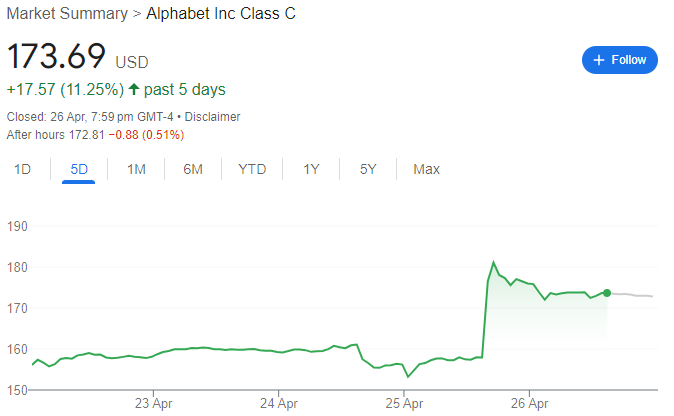

Alphabet stock surges to an all-time high

The Google owner Alphabet stocks also saw improvement after its earnings report for the first quarter, which also quoted figures more than expected. Its shares increased 11% to a record high and closed at a high of 171.95 on Friday, April 26.

The search giant revealed revenue of $80.5 billion, which was expected to be $78.7 billion, and earnings per share of $1.89, while the estimates were for $1.51. In a client note, a Goldman Sachs analyst said,

“We expect the market to have a positive reaction to Alphabet’s Q1’24 earnings report.”

The Alphabet board also approved a share buyback program worth $70 billion, and for the first time, the company announced a dividend of 20 cents per share. Bernstein analysts also increased their target price of GOOGL from $165 to $180, but they do mention the opportunities that Google nearly missed but somehow made. They noted,

“And through it all Google’s stock somehow clawed its’ way to all-time highs heading into 1Q24 earnings. Google needed to be perfect, or face a repeat of being penalized for micro-misses. It was perfect.”

Source: Streetinsider.

JPMorgan insisted that it would be too early to hold back from AI stocks, as it mentioned Nvidia as a flashpoint as its share saw a 17 percent increase over five days of trading. Bank noted that despite the concerns about the duration of AI development and its possible revenues, which have formed an air pocket for the short term, but investors are convinced about the potential for revenue generation in the long term of AI spending.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan