As Europe grapples with the economic intricacies of monetary policies, the banking sector seems uniquely poised to benefit regardless of the direction interest rates take.

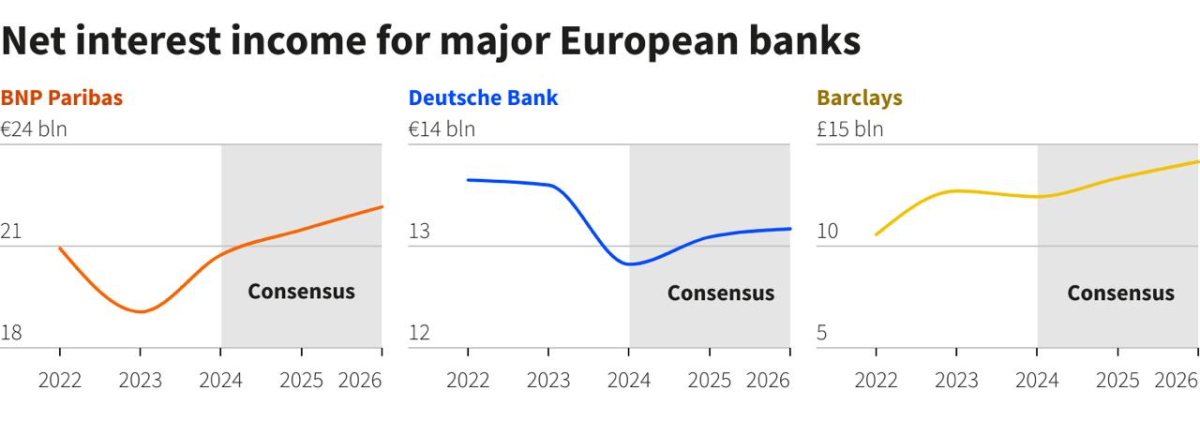

Despite the common assumption that banks thrive solely on higher interest rates, recent developments have revealed that Europe’s major lenders, including BNP Paribas, Deutsche Bank, and Barclays, are not only prepared but also positive about the potential cuts slated for later this year.

Analyzing the Rate Cut Outlook

Jean-Laurent Bonnafé, CEO of BNP Paribas, indicated optimism during the bank’s first-quarter earnings announcement, suggesting a growth in their top line by at least 2% in 2024, thanks to anticipated rate reductions.

This sentiment was echoed on the broader stage, where the European Central Bank is predicted to lower its key interest rates two or three times in the next year, potentially dropping the deposit rate to between 3.25% and 3.5% from the current 4%.

Financial markets and analysts draw these expectations from LSEG calculations, which utilize interest-rate derivative prices to forecast economic shifts.

The logic here is simple yet profound. While higher rates have historically bolstered banks’ incomes, the looming lower rates are also beneficial. This is largely because major banks like BNP Paribas have accumulated significant portfolios of fixed-rate assets, such as mortgages, which only gradually adjust over time.

Strategic Financial Management Amid Changing Rates

The dynamic is particularly interesting when considering the cost dynamics of bank liabilities. For instance, BNP Paribas, with its hefty portion of corporate deposits and retail savings products, is likely to see a rapid decrease in interest expenses as rates drop.

Concurrently, returns from older, maturing loans contracted at lower interest rates continue to augment their financial statements. Similarly, Barclays employs extensive hedging strategies to mitigate the volatile effects of fluctuating rates, securing approximately 4 billion pounds in gross revenue for 2024.

Moreover, the trio of banks, despite their resilience in adapting to changing monetary policies, still trades at a significant discount to their book values, suggesting that investors may still harbor reservations about the sector’s long-term profitability.

On the earnings front, Deutsche Bank reported a 9% decrease in net interest income in the first quarter of 2024 compared to the previous year, while Barclays maintained a steady net interest income year-over-year.

Market Reactions and Policy Implications

The broader implications of ECB’s potential rate cuts are influenced by global economic conditions, notably the U.S. Federal Reserve’s policies. Fabio Panetta, head of Italy’s central bank, underscored this point, suggesting that an extended period of high U.S. rates might compel the ECB to lower its rates to counteract tighter global financial conditions.

ECB'S PANETTA: TIMELY AND SMALL RATE CUTS WOULD COUNTER WEAK DEMAND AND COULD BE PAUSED AT NO COST.

— FinancialJuice (@financialjuice) April 25, 2024

This, however, introduces a delicate balancing act for Europe, striving not to diverge excessively from the Fed to avoid negative spillovers.

Investor sentiment reflects these complexities, with reduced expectations for rate cuts following the Fed Chair Jay Powell’s remarks on persistent high U.S. inflation. This anticipation affects European bond yields and, consequently, the ECB’s strategy, which aims to commence rate reductions in June if inflation continues to align with their targets.

Furthermore, lending figures from the ECB indicate a sluggish response from the market, with modest increases in corporate lending and a downturn in household lending, setting a new low for the decade. These metrics are telling signs of the tightrope the ECB walks in managing inflation expectations while fostering economic growth.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan