According to CoinGecko Research, the Solana network has emerged as the dominant blockchain ecosystem so far this year, securing 49.3% of global crypto investor interest in chain-specific narratives. The report attributes this surge in popularity to Solana’s price recovery, nearing its 2021 highs, along with the strong performance of ecosystem projects like Pyth and native memecoins such as dogwifhat.

Top 20 Most Popular Blockchain Ecosystems on CoinGecko

— CoinGecko (@coingecko) March 20, 2024

1. Solana

2. Ethereum

3. BNB Smart Chain

4. Cosmos

5. Avalanche

6. Arbitrum

7. Base

8. Sei

9. Sui

10. Polygon

11. TON

12. zkSync

13. Cardano

14. Polkadot

15. Metis

16. Fantom

17. Injective

18. PulseChain

19. Aptos

20. Hedera

On Monday, Solana’s price exceeded $200 for the first time in two years, marking its highest level since 2021. This is part of a broader trend that saw SOL’s price increase by over 700% in the past 12 months, with a 7% rise in the last 24 hours alone.

Moving forward, Coinbase’s market update highlighted approximately $11 billion worth of transactions on the Solana blockchain in a 24-hour period on Monday, driven largely by a variety of smaller tokens, including memecoins.

The Solana network has also seen significant activity on decentralized exchanges (DEXs) like Jupiter and Raydium, with traders focusing on memecoins such as Bonk and Slerf. This shift has allowed Solana-based DEXs to gain market share from Ethereum DEXs like Uniswap over the past four months. Automated market makers (AMMs) such as Raydium, Orca, and the Jupiter aggregator have been instrumental in this growth, facilitating the rapid creation and trading of new tokens.

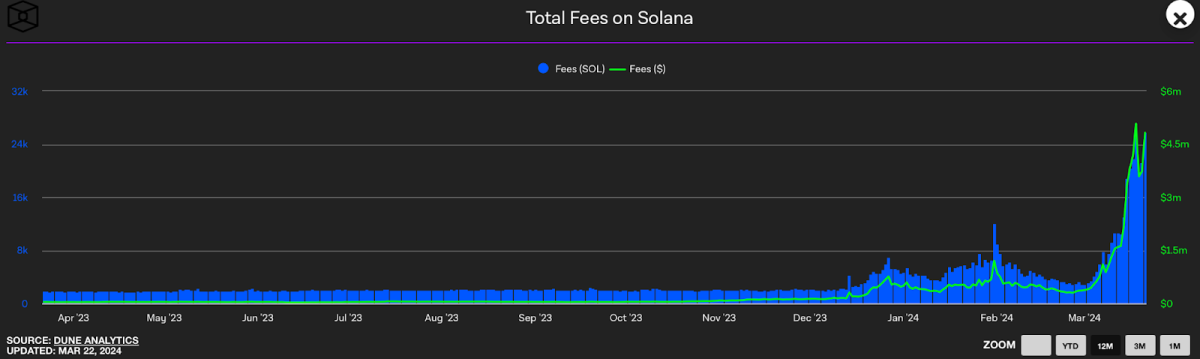

Solana’s onchain volumes have increased significantly, with network fees reaching new heights. Data from The Block’s Data Dashboard shows a surge in daily transaction fees on Solana, with total fees hitting an all-time high of $5.08 million on Monday. This increase in transaction fees, observed since early March, indicates a heightened level of network activity and engagement among users.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

Circle's cross-chain transfer protocol debuts on Solana mainnet

Circle's cross-chain transfer protocol debuts on Solana mainnet