Bitcoin’s on the brink of a big event this week, as the reward for mining the cryptocurrency is about to get sliced in half. Previously, miners received 900 bitcoins daily, but come this Friday, that number will plummet to just 450. This is a scheduled event that happens every four years, designed to keep inflation in check by limiting the supply of Bitcoin, which will never exceed 21 million coins.

Crunch Time for Miners

Satoshi Nakamoto, the legendary creator of Bitcoin, crafted these rules to make the coin scarce and valuable. But as we hit the fourth such ‘halving’, not everyone’s celebrating. For miners, the folks whose computers do the heavy lifting to secure the network and process transactions, this halving could spell financial disaster.

Especially for those whose operations gulp down expensive energy. Andrew O’Neill from S&P Global’s Digital Assets Research Lab hit the nail on the head. Less profitable miners may have to shut down, leaving only the big fish with access to cheap power.

This reduction in mining rewards is a fundamental challenge that could shake up how Bitcoin works. Satoshi’s vision was clear, right? A decentralized digital currency, free from the clutches of banks and governments.

Yet, as mining becomes less profitable, there’s a real risk that only a handful of operators will be left. This concentration could lead to what’s feared as a ’51 percent attack’—where one group could potentially take control of the majority of mining and, thus, the blockchain itself.

Fee or Flee?

The halving is pushing the community to a crossroads. To keep their heads above water, miners might start prioritizing transactions that include fees. Currently, these fees are voluntary. Kind of like tipping your server. Not required, but it gets your transaction processed faster.

But with rewards halving, these fees might become the lifeline for miners. However, jacking up fees comes with its own bag of worms. Higher costs could deter people from using Bitcoin for everyday transactions, slowing down its adoption as a regular currency.

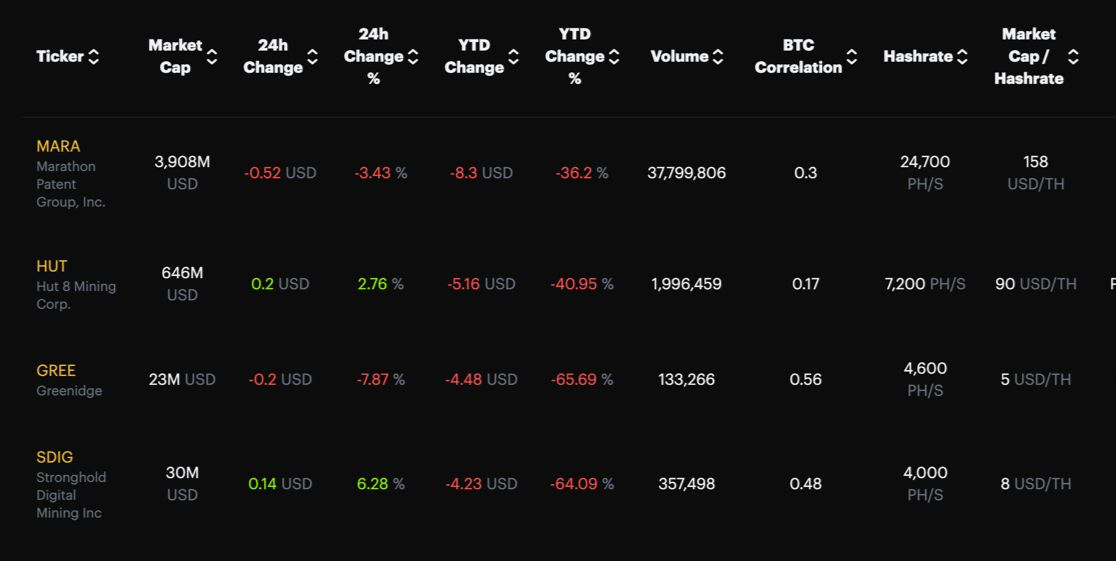

The chatter in the crypto community suggests a reluctant shift towards these fees is already underway. Last year, a look at the numbers showed that companies like Marathon Digital were beginning to make a huge chunk of their income from these fees, potentially changing how Bitcoin economics might operate permanently moving forward.

Meanwhile, the miners are currently stashing Bitcoins like squirrels prepping for winter. Companies like Marathon Digital, CleanSpark, and Bitfarms have reportedly hoarded about $2.8 billion worth of Bitcoin, gearing up for a post-halving price surge.

It’s a risky game. As Larisa Yarovaya from the University of Southampton puts it, it’s a “game of chicken.” Miners are betting it all on Bitcoin’s price continuing to rise.

The broader scene looks just as shaky.

Analysts are eyeing the aftereffects of the halving, predicting a shift in global mining. With rewards down, miners in search of profit might migrate to places with cheaper energy, like Latin America or Asia.

This could dramatically reshape where and how Bitcoin mining takes place, potentially ushering in a new era of centralization. And, guys, this is exactly what Bitcoin was designed to avoid.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap