The world of Bitcoin is looking more like a rollercoaster in an amusement park, only this ride isn’t amusing everyone. The big buzz in the crypto sphere has been around the new US spot exchange-traded funds (ETFs) for Bitcoin. But let’s not pop the champagne just yet. Since their advent in early January, Bitcoin hasn’t been basking in the expected glory. Instead, it’s been a downhill ride with a roughly 20% fall, nosediving to around $39,000. This tumble isn’t just a number; it’s a cold splash of reality for investors who had their hopes hitched to these ETFs.

The Skepticism Spectrum

Let’s cut through the haze and see what’s really happening. Deutsche Bank, not exactly a small fish in the financial pond, conducted a survey post the ETF launch. They didn’t just ask a couple of folks down the street; this was a 2,000-people strong survey across the U.S., U.K., and Europe. The findings? Let’s just say, not a parade for Bitcoin enthusiasts.

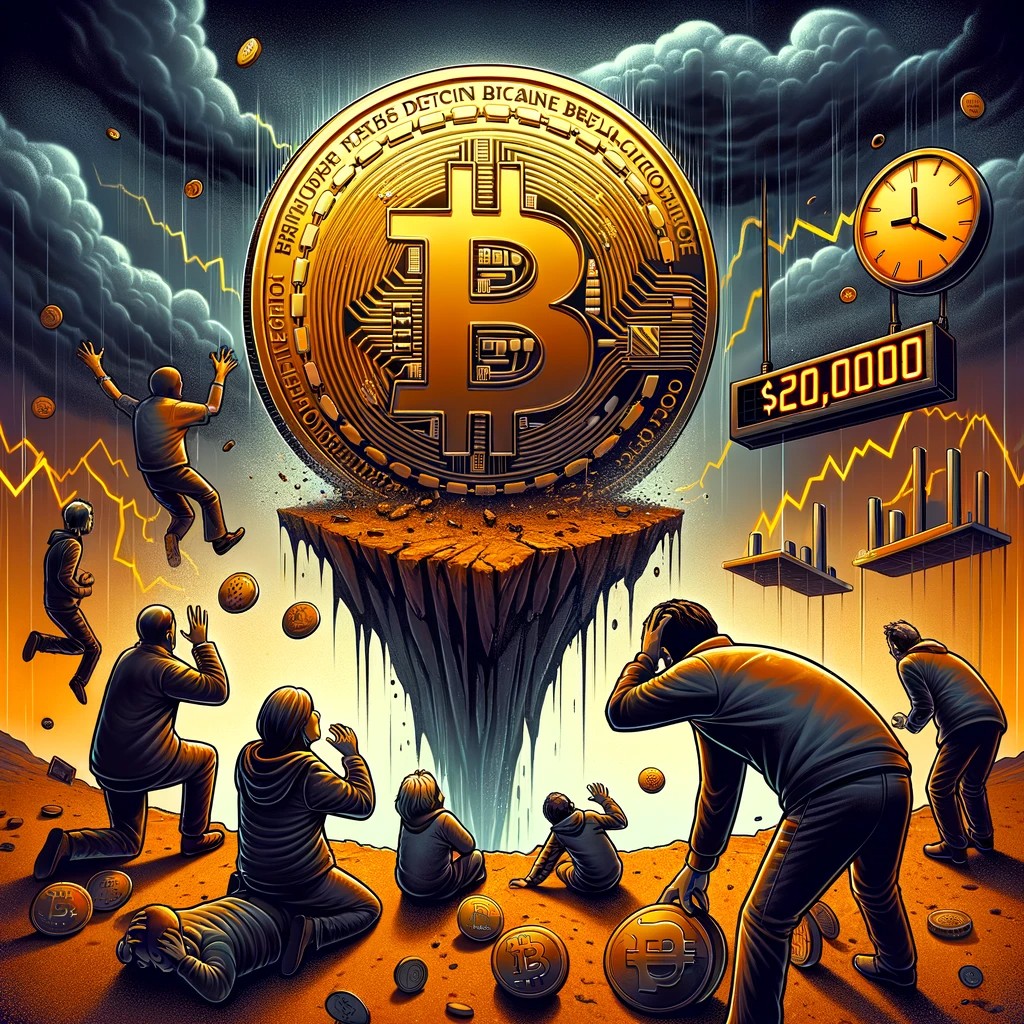

Over a third of these respondents believe Bitcoin might take a dive below the $20,000 mark by year-end. And, if you thought that was grim, over half of these folks are betting on a major cryptocurrency crash within the next couple of years.

But wait, there’s more. Focusing on Bitcoin, about 39% of the survey participants see it sticking around, but a slightly higher 42% are ready to bid it farewell. What does this tell us? Well, for starters, there’s a significant chunk of people out there who aren’t sold on the Bitcoin dream. And it’s not just about being naysayers; many of these views are likely shaped by events like the FTX collapse in 2022 and the SEC taking swings at Binance and Coinbase.

The ETF Effect and Market Moves

Now, let’s talk about those ETFs that were supposed to be the golden ticket for Bitcoin. Sure, they offered a more straightforward way for Joe and Jane to jump onto the Bitcoin bandwagon, but the reception has been lukewarm. Even with the SEC’s green light for not one but eleven spot BTC ETFs, the aftermath hasn’t been a bed of roses. On launch day, Bitcoin did soar past $49K, giving everyone a momentary high. But that joyride was short-lived. The asset soon found itself hovering around the $43,000 mark, losing its bullish steam.

Fast forward to now, and Bitcoin is trading at around $39K. And if you think that’s just a casual dip, here’s a number for you: $332.83 million in overall liquidations in the last 24 hours alone. The biggest single liquidation order? A whopping $5 million on Bybit. This isn’t just a market correction; it’s a reality check.

And it’s not just Bitcoin feeling the heat. The Grayscale Bitcoin Trust (GBTC), since morphing into an ETF, has seen more than $2 billion worth of sell-offs. The market’s sending a message loud and clear: bullish confidence is waning, and the negative funding rates are spelling out ‘seller’s market.’

Now, let’s not paint an entirely bleak picture here. The crypto world is slowly but surely inching towards institutionalization. Traditional financial players are dipping their toes in the crypto pool, helping mature this sector into a more established asset class. But let’s be real, the road to crypto glory is fraught with uncertainty and the occasional heart-stopping drops.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.