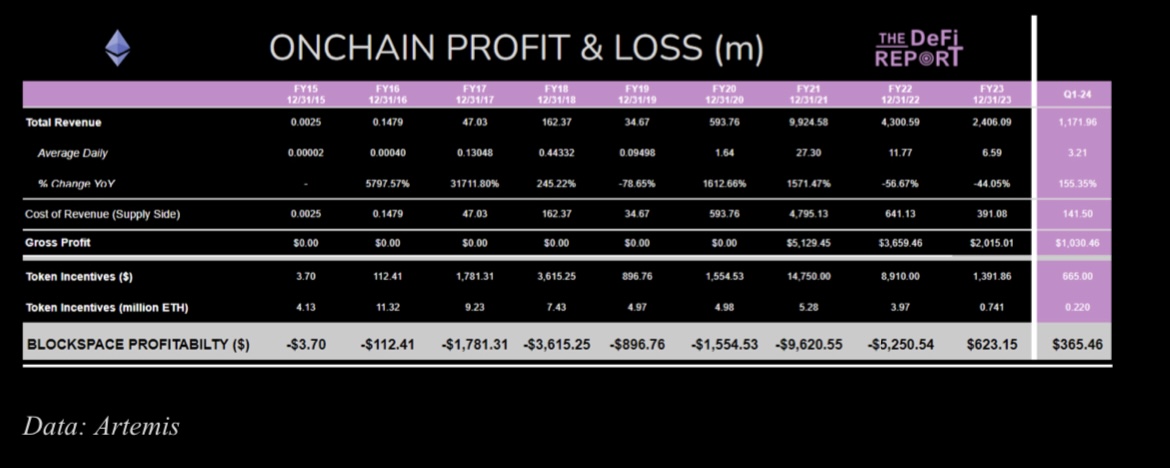

Blockchain network Ethereum is on the verge of actualizing an annual return of $1 billion. According to the report, the blockchain network registered a massive $365 million income in Q1, boosting its year-on-year quarterly revenue to 155%. In the report by analyst Michael Nadeau, this Q1 2024 revenue is a huge leap from its previous $123 million that it registered in Q4 2023.

Ethereum set to reach $1 billion annual revenue

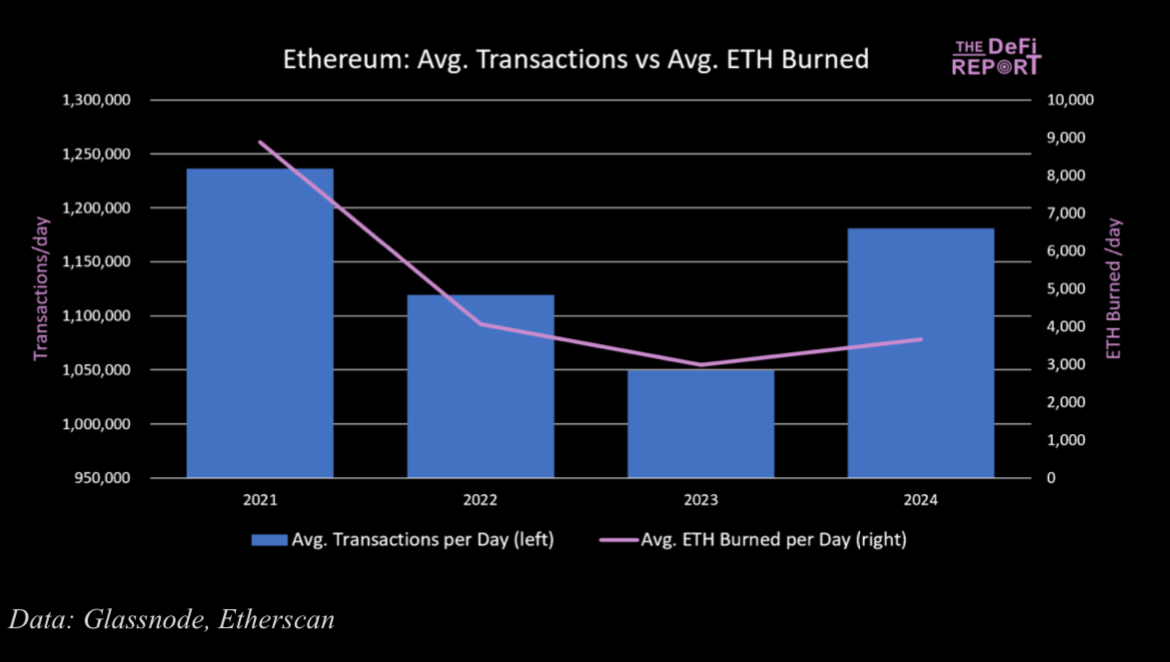

Since the beginning of this year, Ethereum has registered an average daily transaction of 1.15 million. This figure is slightly higher than last year’s figure of 1.05 million and slightly lower than 2021’s 1.25 million average daily transactions.

Since its launch in 2015, the network registered its first profitable year in 2023, seeing a revenue of around $623 million. Notably, the revenue registered in 2023 was lower than its highest-ever revenue of $9.9 billion in 2021.

Nadeau mentioned that this new development was due to the move to proof-of-stake consensus in September 2022. Since that period, the amount of token incentives paid to validators on the network dropped by 80%. He added that Ethereum has experienced a fee surge of 58% since 2017.

Market predictions and catalysts for bullish trends

In his market prediction for the future, Nadeau noted that digital assets will outperform every other asset. He also expects liquidity to rise drastically in the next few years as the United States needs to refinance some of its debt this year. He noted that the market had priced in three rate cuts this year from the Federal Reserve. He added that it should help several assets like tech stocks and quality digital assets.

Nadeau highlighted three catalysts that could trigger the bullish return that is expected in the crypto market. He noted that the United States spot Bitcoin exchange-traded funds (ETFs), the Bitcoin halving, and the ‘innovative cycle’ were the catalysts that could set up a bullish trend for the market. He explained that Bitcoin ETF would provide a gateway for the interest in cryptocurrencies due to its broad access while the halving has historically led to Bitcoin’s surge in performance.

Discussing the innovation cycle, he explained that it would drive venture investment that would trigger a new wave of retail interest in the market. He also discussed the relationship between Bitcoin and Ethereum. He explained that Bitcoin experiences its bullish trend at the beginning of the trend while Ethereum and a few other altcoins will experience it at the end. Altcoins have outperformed Bitcoin during their bullish phase over the last two cycles.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap