In an unexpected turn of events, the transaction fees for Bitcoin took a nosedive the very day after hitting a historic peak. Just a moment ago, on April 20, Bitcoin transaction fees skyrocketed to an average of $128. Fast forward 24 hours, and those fees have come crashing down to a more palatable $8-$10 for medium-priority transactions.

Mempool.space, a site that provides real-time data on Bitcoin transactions, recorded this massive decrease, providing a stark contrast to the fever-pitched costs just a day prior. On April 20, Bitcoin fees soared to the extent that the total fees collected were a $78.3 million, surpassing Ethereum’s collections by more than 24 times, a feat highlighted by Crypto Fees.

Halving Impact and Fee Volatility

The halving event, a significant milestone in the Bitcoin ecosystem, occurred on the same day, cutting the reward for mining new blocks in half from 6.25 BTC to 3.125 BTC.

This anticipated event in the cryptocurrency world is designed to decrease the rate at which new bitcoins are created, aiming to make the asset more scarce and theoretically more valuable over time. During the halving, block 840,000 witnessed a staggering 37.7 BTC paid in fees, highlighting its status as the most coveted block mined that day.

Notably, the high fee was partly driven by users of memecoin and non-fungible token (NFT) enthusiasts, who leveraged the new Runes protocol to inscribe their transactions in the block. This block alone, comprising 3,050 transactions, saw an average fee close to $800 per transaction, underscoring the high stakes and intense competition among miners and users at this critical juncture.

However, as we moved past block 840,200, the frenzy cooled, and the fees normalized to between 1 and 2 BTC per block, providing some relief to users transacting on the network. This normalization might seem surprising, but it reflects the typical volatility and adjustment of the network following such a monumental event.

Mining Economics Post-Halving

On the mining front, large, publicly listed Bitcoin mining companies had been getting ready for this event, understanding that the halving could significantly impact their operations. These companies had been bulking up their orders for more efficient mining hardware, scaling up their electrical capacities, and pushing their hash rates to higher levels.

Hash rate, a key indicator of the computational power in the Bitcoin network, reflects the robustness and security of the processing activities miners undertake.

This strategic preparation by large miners aimed to cushion the reduced block reward effect. In contrast, smaller mining outfits faced the heat as they grappled with potential operational viability issues, increasing the likelihood of a shakeout where only the most efficient operations could thrive.

This dynamic could lead to more concentrated mining operations and possibly more mergers and acquisitions in the industry as smaller players either scale up or bow out.

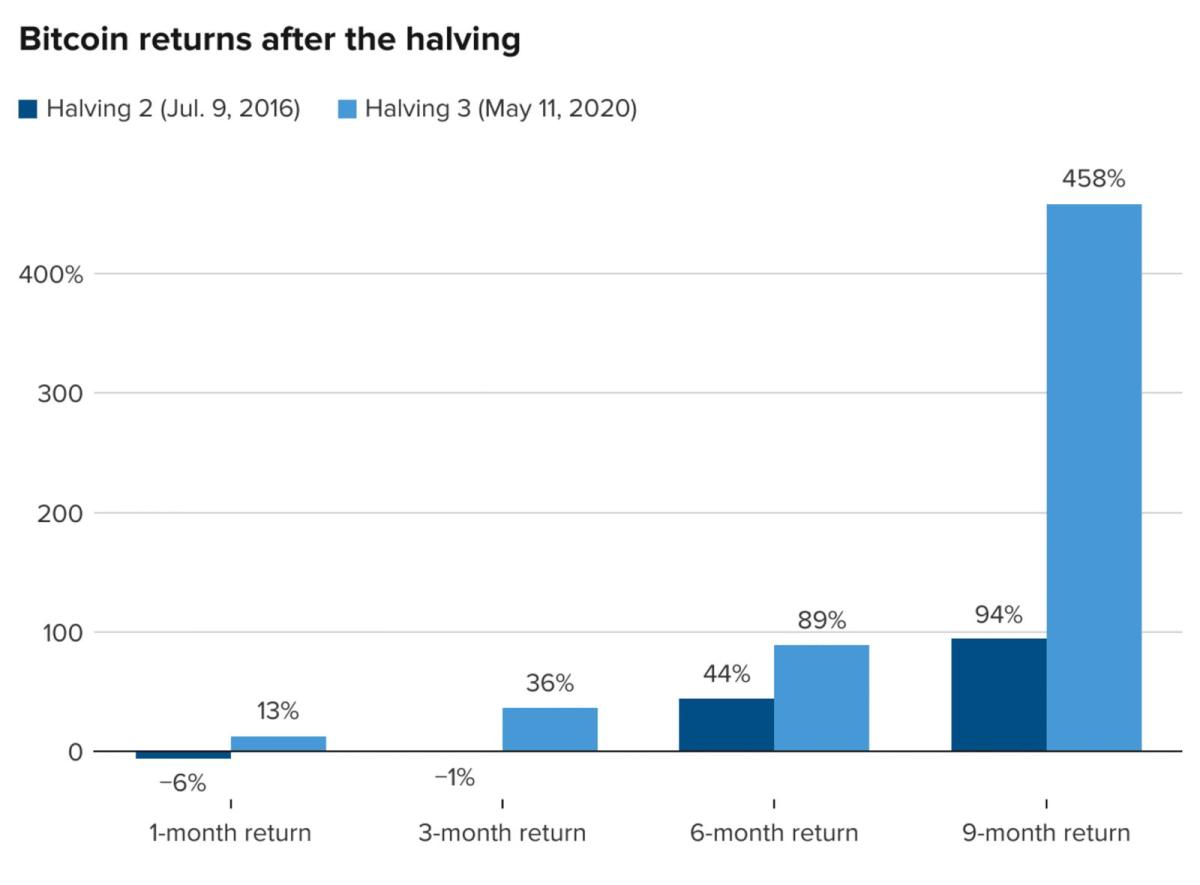

The immediate aftermath of the halving didn’t bring about a substantial shift in Bitcoin’s price, which slightly increased by 1.5% to $64,840. Despite the modest uptick, it’s crucial to note that historically, the full economic impacts of halving events on Bitcoin’s market value and mining ecosystem have taken months to materialize fully.

Overall, the dramatic fluctuations in transaction fees and the strategic maneuvers by mining operations underscore the complex interplay of technology, market dynamics, and human behavior in the Bitcoin ecosystem. As Bitcoin continues to mature, these events offer valuable insights into the resilience and adaptability of decentralized financial systems.

Throughout this period, Bitcoin continued to outpace Ethereum in terms of transaction fees, reinforcing its position in the cryptocurrency hierarchy.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.