TL;DR Breakdown

- Bitcoin fell by almost 50 percent in the past few weeks from its ATH.

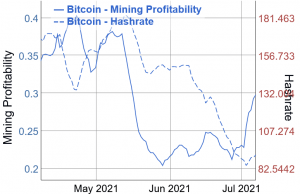

- Bitcoin hashrate also went down by historical levels amidst the China mining ban.

- In the first week of July, the Bitcoin mining profitability surged by 31 percent.

Back in June, China banned crypto mines, which led to a mass evacuation of miners from the country. While major mines were shut down, the closure of Chinese mines played a vital role in the downfall of the Bitcoin hashrate.

Despite such harsh conditions and Bitcoin’s price dropping to almost half of its all-time-high, the coin saw a massive surge in mining profitability in the first week of July. There was an increase of around 31 percent in the profits from Bitcoin mining.

Bitcoin hashrate surge might turn things around for miners.

The performance of Bitcoin since mid-May has been lacking. While the mining profitability fell by almost 41 percent, the Bitcoin hashrate went down too when BTC/USD was around $50,000.

After the surge in the first week of July, it can be seen that Bitcoin mining profitability is at the levels of mid-May, and soon, we might see a great recovery. This is great news, considering how China banned mining from the country.

Comparison to the start of 2021

If we compare the Bitcoin hashrate now to the start of 2021, we will see a drop of around 54 percent. From mid-May to July, the Bitcoin hashrate had constantly been falling almost constantly. For the past four days, the BTC hashrate has been steadily improving and is up by 8 percent.

If we talk about the block time, there has been a notable drop too. The network has targetted a block time of around 10 minutes, while the highest level was achieved some time ago at around 17 minutes. After this high, the block time has dropped by over 27 percent.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan