The United States spot Bitcoin exchange-traded funds (ETFs) have yet again experienced significant outflows. The ETFs registered a massive outflow of $4.3 million on Thursday, bringing it to four consecutive days of outflows. Notably, these events have yet to reduce despite the hype surrounding the upcoming BTC halving event scheduled to occur on April 20.

Spot Bitcoin ETFs register significant outflows

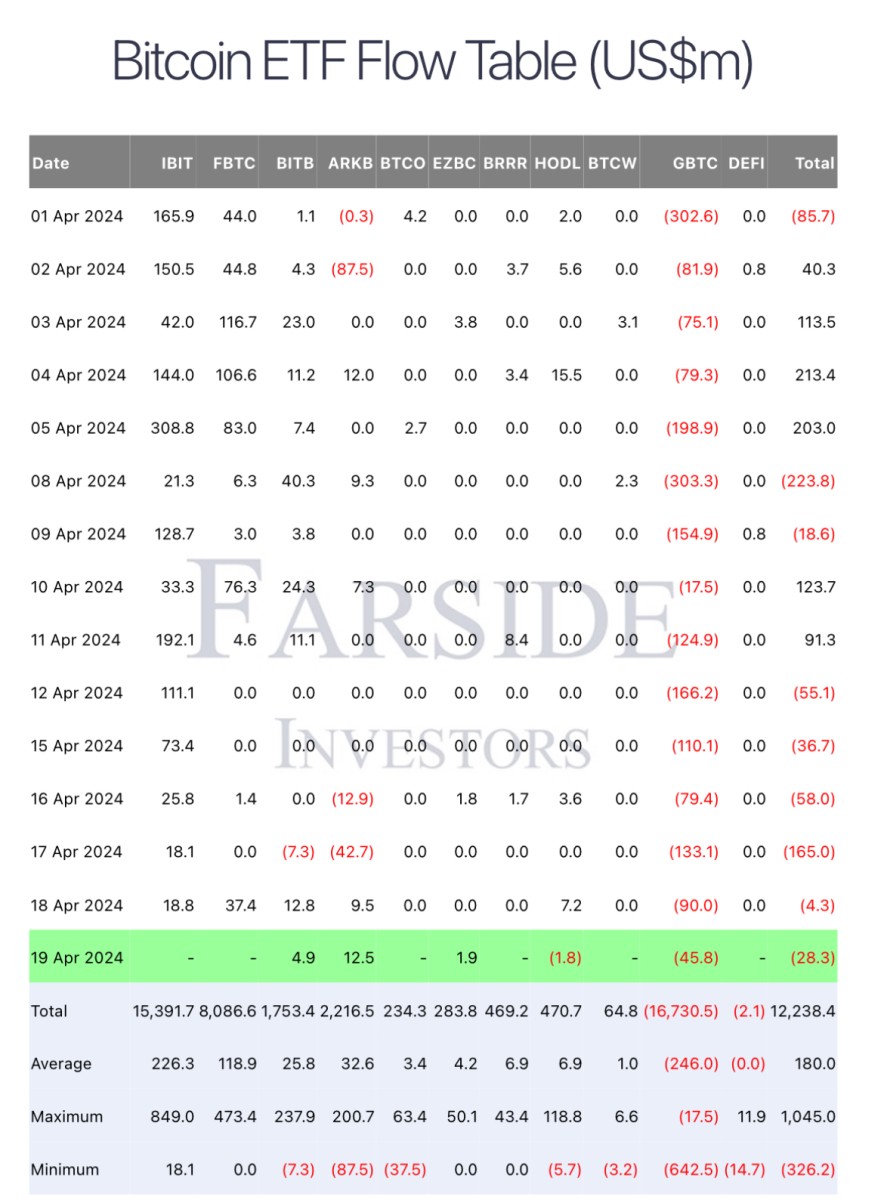

According to data from Farside Investors, the total spot Bitcoin ETFs in the United States have experienced an outflow of $319 million since April 12. In the report, Grayscale’s GBTC accounted for the largest share of the total outflows.

For instance, GBTC experienced a massive outflow of $90 million on Thursday. However, the outflow was soon offset by inflows into Fidelity and BlackRock’s ETFs.

Grayscale’s GBTC has been experiencing massive outflows since the first day of its launch. Analysts and most of the crypto market community have faulted its costly fee structure as one of the reasons for this. This means that the outflows are exactly not a problem, however, another problem is the slow inflows into other ETFs. BlackRock’s ETF saw an inflow of $18.8 million on Thursday, down by 93% from its monthly high of April 5.

Analysis of the slowed inflows into BTCETFs

According to a report by Matrixport, it noted that key liquidity drivers have slowed down for some weeks. “Key liquidity drivers, such as stablecoin growth and US-listed Bitcoin ETF inflows, have slowed down – as we have mentioned for several weeks. ETF flows peaked on March 12, and four consecutive days of net outflows have recently been seen. Demand for US-listed BTC ETFs appears saturated, as even a 10-15% decline in BTC prices has not increased net inflows,” Matrixport said.

The asset is trading down by 13%, trading at $64,700. The asset’s decline has been tied to different factors especially the ongoing spat in the Middle East. Matrixport said that the tension should have been good for BTC but it is the opposite. “This was a real test in cementing Bitcoin as a risk-off asset—unfortunately, Bitcoin somewhat failed as its price stagnated and sold off,” Matrixport said.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan